Technically Speaking

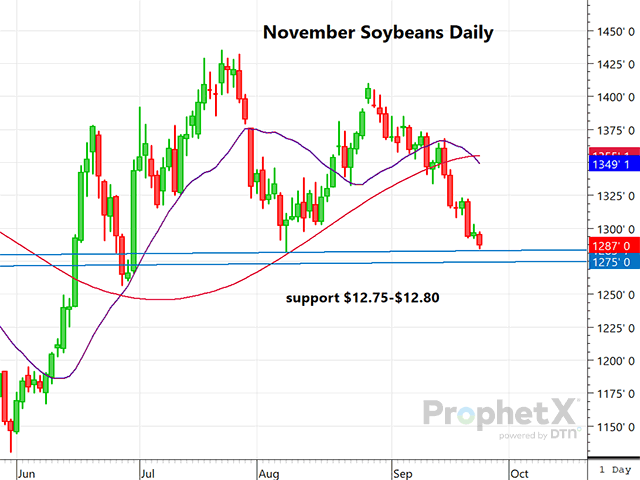

November Soybean Chart Looks Terrible, But Support Lies Just Below

November soybeans have been on a downward path since the end of August, with few interruptions of that bearish move. Just since Aug. 28, the November contract has plunged over $1.25 per bushel. The weakness has come despite early indications that soybean yields were disappointing for the first 10% of 2023 harvest. Some crop scouts and analysts are looking for the final bean yield to fall closer to 49 bushels per acre (bpa) compared to the WASDE estimate of 50.1 bpa.

With the lowest ending soybean stocks in seven years, the market seems like it should be acting better than it has. Just below the early Monday trade is a decent support area at $12.75 to $12.80; but below that one would be hard pressed to find any good chart support. The market has become very oversold and possibly is due for an upside correction. However, overhanging the soybean market is the prediction for another record-large Brazilian soy crop and a rebound in Argentine soy production, which could result in an increase in total South American soy production of close to 30 million metric tons (mmt) (1.1 billion bushels).

Keep an eye on that $12.75 area of November beans for key support, which, if broken, could lead to another leg lower. The short-term fundamentals on beans suggest that support level will hold.

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

Kansas City December wheat has been relentlessly pummeled, with yet another new contract low set Monday. The weakness in wheat can be attributed to Russia's dominance in world export markets, Ukraine's ability to export wheat even without the Black Sea corridor agreement, and the fact that U.S. hard red winter wheat sales are running nearly 50% below last year.

Although the market cannot be labeled as oversold just yet, a look at the weekly continuation chart shows a solid band of support in the $6.80 to $7.00 area. KC December wheat should soon find some support within the next 20 cents below the early Monday low of $7.03.

**

The comments above are for educational purposes only and are not meant as specific trade recommendations. The buying and selling of commodities, futures or options involve substantial risk and are not suitable for everyone.

Dana Mantini can be reached at Dana.Mantini@DTN.com

Follow him on X, formerly Twitter, @mantini_r

(c) Copyright 2023 DTN, LLC. All rights reserved.

Comments

To comment, please Log In or Join our Community .