Technically Speaking

Bull Spreads Raise Questions For Summer Corn, Soybean Prices

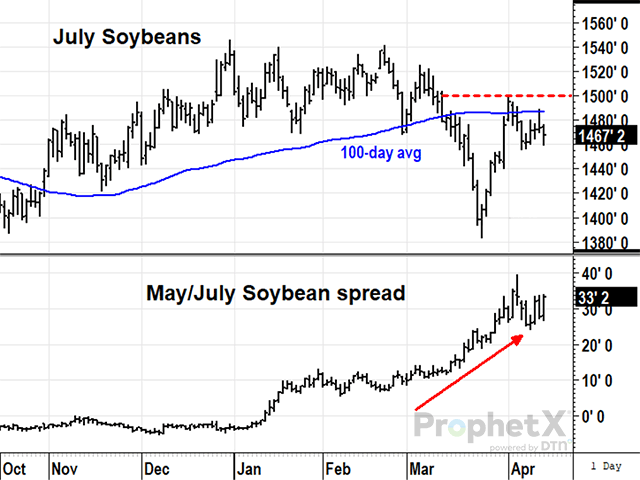

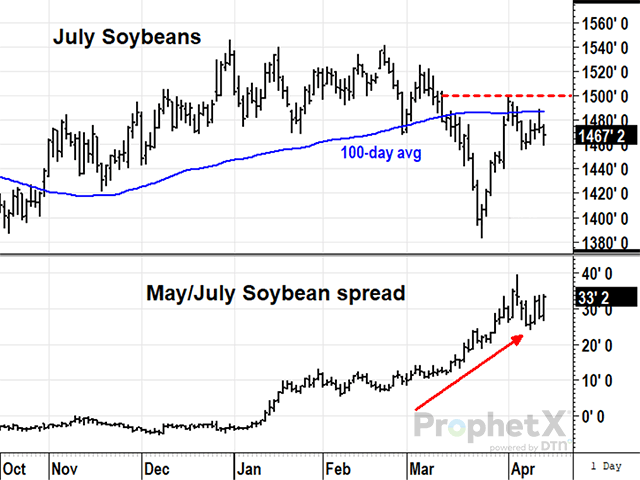

July soybeans closed up 4 3/4 cents at $13.67 1/4 in the week ended April 14, staying below the 100-day average at $14.87 and below the one-month high near $15.00. The May contract is currently getting all the bullish attention in soybeans, ending at $15.00 1/2 Friday, 33 1/4 cents above the July contract. The last time the May premium was that large on this date was in 2013, the start of a bullish move for old-crop soybean prices that lasted until July 9.

The bullish key for the July contract in 2013 happened in the final days of trading for the May contract when the July price closed at a new one-month high of $14.19 on May 13 and made a run to its peak of $16.13 on July 9. On the other hand, a similar setup in 2021 had a bearish result as July soybean prices peaked on May 12 and never traded higher. The key for July soybeans in 2023 will be to keep an eye on the $15.00 mark. A clear close above $15.00 would suggest a competition for available supplies and the resumption of a bull trend. Anything less will suggest that end users are satisfied with available supplies and are comfortable to wait for the next harvest.

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

Similar to old-crop soybeans, July corn is also the less-favored contract in a May/July spread that shows May 30 1/2 cents above the July contract. July corn closed up 16 cents at $6.35 3/4 in the week ended April 14, sharing some of the benefit of seeing China add 17.2 million bushels (mb) of old-crop purchases to last week's list of U.S. export business. Unlike soybeans, part of July's discount to May is explained by USDA's early estimate Brazil corn production will achieve a record high 125.0 million metric tons (mmt) or 4.92 billion bushels (bb) in 2023, boosted by a big safrinha harvest in July.

In this case, it can be difficult to separate out how much of the May premium is due to active commercial demand for old-crop corn and how much is due to a bearish outlook for competition from Brazil. DTN's national corn basis is currently at its strongest level in over 20 years, making a strong case for bullish domestic demand. For now, Friday's July corn close at $6.35 3/4 remains below resistance near $6.46, the site of both, the 100-day average and the one-month high. A clear close above $6.46, if it happened, would give July corn the bullish potential it is currently lacking.

**

Comments above are for educational purposes only and are not meant as specific trade recommendations. The buying and selling of grain or grain futures or options involve substantial risk and are not suitable for everyone.

Todd Hultman can be reached at Todd.Hultman@dtn.com

Follow him on Twitter @ToddHultman1

(c) Copyright 2023 DTN, LLC. All rights reserved.

Comments

To comment, please Log In or Join our Community .