Technically Speaking

Bearish Trends Abound in Livestock

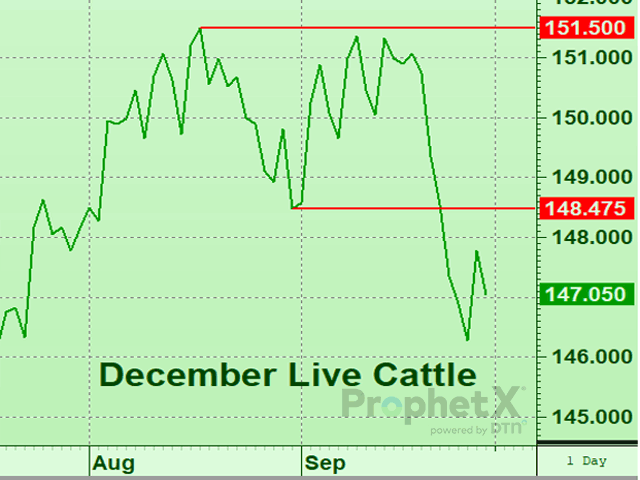

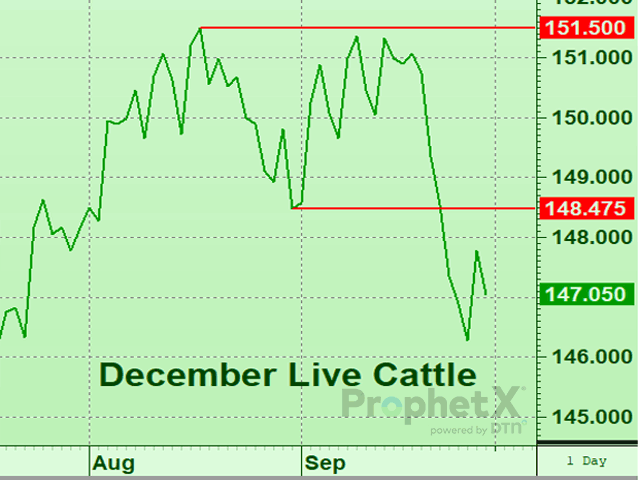

Weakness has been the dominant feature in the live cattle market over the last two weeks as the December contract has fallen below the 50-, 100- and 200-day moving averages. The trick with this market is trying to determine which phase we're currently watching unfold to know whether the selling is merely pausing or complete. Our preferred wave count would point toward the weakness in later August as wave-a or wave-1, with the countertrend rally to mid-August being wave-b or wave-2. We would actually prefer using a close-only chart in this instance as it shows the rally in mid-September did not produce a new high close above the August highs, even though intra-day trade did produce a new high. With this in mind, the most important level for bulls would be the late August lows around $148.475. If selling pressure, and therefore the correction, is over, bulls need to press through that resistance candidate. If the selling pressure is not over, that resistance candidate should hold, signaling another run at the lows from last week is likely forthcoming. These issues considered, a bearish policy in live cattle remains advised until or unless the late August lows are violated.

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

Bearish sentiment is even more palpable in feeder cattle as the downtrend in place remains entrenched. The reversal posted Friday suggests the coming week is likely in store for more selling pressure with the May lows a foregone conclusion. The key will be looking for a divergence in momentum as those lows are approached, which could be an early signal for bears to pare exposure. When a market turns, it usually slows before doing so, which should be illustrated with a momentum indicator like stochastics, RSI, rate-of-change, MACD, etc. This is not to say we couldn't see buying spurts on our way to the May lows, but until proven otherwise, any bout of strength should be viewed as a selling opportunity. One last note, volume has generally been trending upward on the entire sell-off, highlighting the participation and the strength of the move.

DECEMBER LEAN HOGS:In the same vein as the feeder cattle market, lean hogs have been under significant pressure during the last 7 to 10 sessions. Unfortunately for bulls, there is relatively little support for the December contract until the October 2021 lows around $70.00/cwt. Minor support does exist at the November 2021 highs around $75.225, which was where Friday's settlement landed. If price action this week can hold last week's lows, bulls may have a chance to build a base-and-reversal case. If these lows do not hold, the market likely has another $3 to $6 of downside. One technical fact we found interesting which could be another feather in bulls caps is that the sell-off from $89.075 to $75.325 over the last week measured almost exactly 138.2% of the prior selloff from $91.3 to $81.35. At the very least, this could mean a corrective rally from the end of this wave is close at hand. That said, it is too early to tell whether an A-B-C, three-wave corrective sequence is now complete, or whether we just watched the completion of the third wave of a larger degree five-wave sequence is still to come. Regardless, the downtrend remains in place and a bearish stance is still advised until serious upside can be posted in this market.

**

Comments above are for educational purposes and are not meant to be specific trade recommendations. The buying and selling of grains and grain futures involve substantial risk and are not suitable for everyone.

Tregg Cronin can be reached at tmcronin31@gmail.com

Follow him on Twitter @5thWave_tcronin

(c) Copyright 2022 DTN, LLC. All rights reserved.

Comments

To comment, please Log In or Join our Community .