Technically Speaking

Outside Markets Grab Attention, Once Again

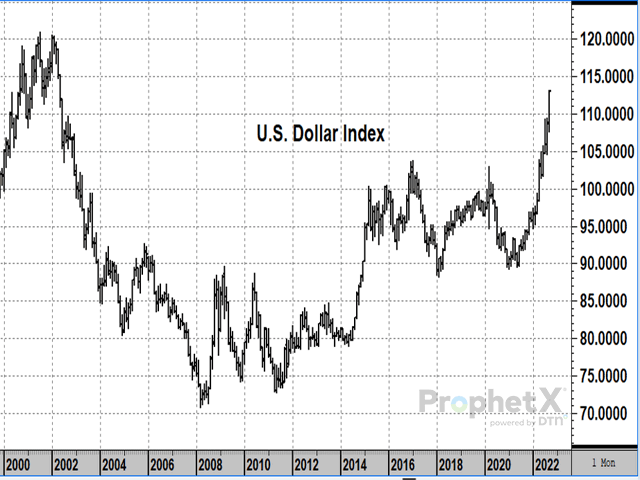

The U.S. Dollar Index was up 4.32 last week, finishing at 113.02 on Friday, Sept. 23, 2022, its highest close in over 20 years. Now up 21% from a year ago, the dollar is on a bullish surge that is putting a lid on commodity prices, even those in tight supply situations. Normally, one would expect inflation to weaken the U.S. dollar, but in this case, the Federal Reserve's campaign to keep raising interest rates and the better-than-most performance of the U.S. economy are sending investors from the currencies of more troubled economies to the safer haven of the U.S. Technically speaking, the dollar is well into a bullish surge of higher prices with no sign of slowing momentum yet. The old high of 121.02 from July 2001 is a possible site for resistance moving forward, but for now, the uptrend is strong.

S&P 500 INDEX:The S&P 500 Index fell 261.77 points last week to 3,693.23 Friday, near its June low and near its lowest prices since January 2021. On Wednesday, the Federal Reserve increased the federal funds rate target by 0.75% to a range of 3.00% to 3.25% and made it clear rates would keep rising until inflation returned to 2%, the Fed's most hawkish comments to date. Stock valuations suffer in comparison to higher interest rates and there is a concern of further economic slowing ahead. The index is down 23%, year-to-date, and the trend is clearly lower with no sign of change in downward momentum. Prices are at risk of taking out the June low of 3,636.87.

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

Crude oil has been the primary driver of higher prices after the pandemic and the war in Ukraine -- the fuel behind the rising price trend the Fed is trying to suppress. November crude oil fell $6.02 last week to $78.74 Friday, the lowest close since January 2021. Increased worries about slowing economies are currently outweighing concerns about tight levels of world oil production and pressuring prices lower. Technically, the trend in November crude oil broke lower July 5 and has traded below the 100-day average since. However, prices have not gone down easy as the market knows production is limited. There is no sign of change in downward momentum yet, but a possible reversal is worth watching for.

**

Comments above are for educational purposes only and are not meant as specific trade recommendations. The buying and selling of grain or grain futures or options involve substantial risk and are not suitable for everyone.

Todd Hultman can be reached at Todd.Hultman@dtn.com .

(c) Copyright 2022 DTN, LLC. All rights reserved.

Comments

To comment, please Log In or Join our Community .