Technically Speaking

Weekly Analysis: Livestock Markets

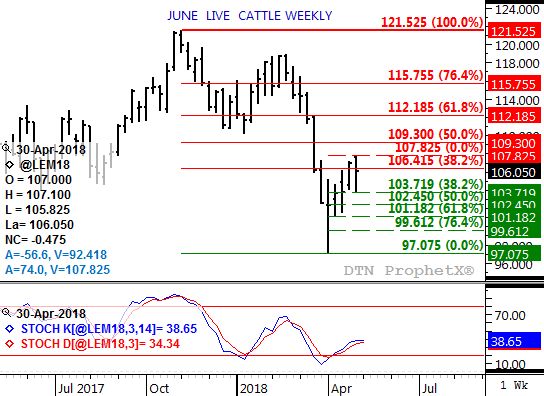

Live Cattle: The June contract closed $0.95 lower at $106.05. June live cattle posted a bearish outside range last week, indicating a likely Wave 1 peak of its secondary (intermediate-term) 5-wave uptrend. If so, Wave 2 would be expected to retrace most of Wave 1, putting the low side target near $99.60. This price marks the 76.4% retracement level of Wave 1 from $97.075 through last week's high of $107.825.

Feeder Cattle: The August contract closed $1.925 lower at $146.325. Similar to live cattle, August feeders posted a bearish outside range last week. This signals a likely peak to Wave 1 of the contract's secondary (intermediate-term) 5-wave uptrend, with the low-side target down near $138.325. This price marks the 76.4% retracement of Wave 1 from $135.00 through last week's high of $149.075.

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

Lean Hogs: The June contract closed $0.90 higher at $73.525. Unlike cattle contracts, June lean hogs look to have potentially established Wave 2 lows of an ongoing secondary (intermediate-term) 5-wave uptrend. Last week's low of $72.20 was test of support near $72.35, a price that marks the 76.4% retracement level of Wave 1 from $70.25 through the recent peak of $79.10.

Class III Milk: The June contract closed $0.49 higher at $15.56. The market extended its secondary (intermediate-term) uptrend to last week's high of $15.75, above technical resistance at $15.29. This price marks the 23.6% retracement level of the previous downtrend from $25.30 through the low of $12.20. However, weekly stochastics are now near 90% indicating a sharply overbought situation and putting the market in position for a bearish turn.

Soybean meal: The July contract closed $1.60 lower at $393.70. After posting a new high of $406.50, last week's lower close looks to have established a bearish spike reversal. If so, this would indicate the contract's secondary (intermediate-term) trend is now down. Weekly stochastics are bullish above the overbought level of 80%, in position for another bearish crossover.

Corn (Cash): The DTN National Corn Index (NCI, national average cash price) closed at $3.70, up 11 cents for the week. The NCI extended its secondary (intermediate-term) uptrend last week. Next resistance is at $7.73, a price that marks the 76.4% retracement level of the sell-off from $4.01 (week of June 13, 2016) through the low of $2.85 (week of August 22, 2016). National average basis firmed 3 cents last week, calculated at 36 cents under the July futures contract last Friday.

To track my thoughts on the markets throughout the day, follow me on Twitter: www.twitter.com\DarinNewsom

Comments

To comment, please Log In or Join our Community .