Technically Speaking

Weekly Analysis: Livestock Markets

Live Cattle: The June contract closed $1.80 lower at $123.575. The secondary (intermediate-term) trend remains up while the minor (short-term) downtrend has last two weeks. However, this minor (short-term) downtrend looks to be nearing its end as the futures contract holds above secondary trendline support (calculated at $121.875 this week) while daily stochastics near a bullish crossover below the oversold level of 20%.

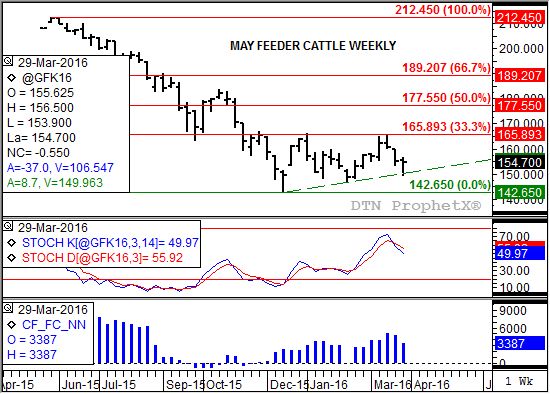

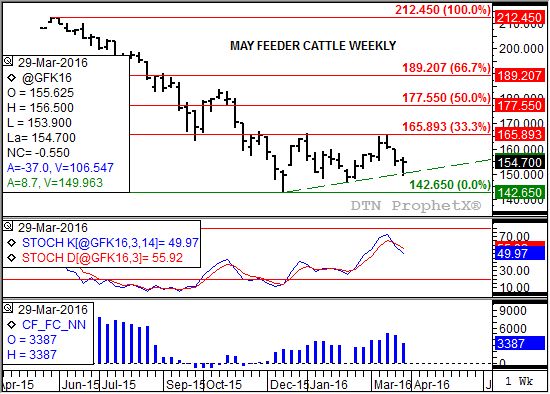

Feeder Cattle: The May contract closed $0.325 lower at $154.70. The secondary (intermediate-term) trend remains sideways-to-up. Resistance remains near $165.90, a price that marks the 33% retracement level of the previous downtrend from $2.1245 through the low of $142.65. Trendline support is calculated this week at $150.45.

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

Lean hogs: The June contract closed $1.475 lower at $79.375 last week. The secondary (intermediate-term) trend remains down with contract closing slightly below initial support at $79.40. This price marks the 33% retracement level of the previous uptrend from $70.25 through the recent high of $83.975. Next support is between $77.10 and $74.825, the 50% and 67% retracement levels respectively.

Corn (Cash): The DTN National Corn Index (NCI.X, national average cash price) closed at $3.27 3/4, down 15 1/2 cents for the week. The secondary (intermediate-term) trend is sideways-to-down after the NCI.X posted a new low near $3.24 last Thursday. This put the NCI.X between support at $3.29 and $3.22, prices that mark the 61.8% and 67% retracement levels of the previous major (long-term) rally from $2.81 1/2 (October 2015) through the high of $4.05 3/4 (July 2015). As mentioned in the monthly analysis from April 1, monthly stochastics are below the oversold level of 20%.

Soybean meal: The May contract closed $3.00 lower at $272.30. Despite the lower weekly close the secondary (intermediate-term) trend remains up. Initial resistance is pegged at $287.40, the 33% retracement level of the previous downtrend from $344.60 through the low of $258.90. Support continues to come from noncommercial short-covering, with last Friday CFTC Commitments of Traders report* showing this group still holding a net-short futures position of 9,145 contracts, a reduction of 10,921 contracts from the previous week.

*The weekly Commitments of Traders report showed positions held as of Tuesday, March 29.

To track my thoughts on the markets throughout the day, follow me on Twitter: www.twitter.com\DarinNewsom

Comments

To comment, please Log In or Join our Community .