Technically Speaking

Beans vs. Corn: A Look Ahead at 2014

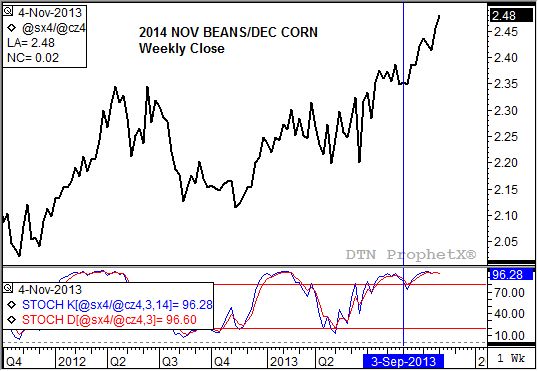

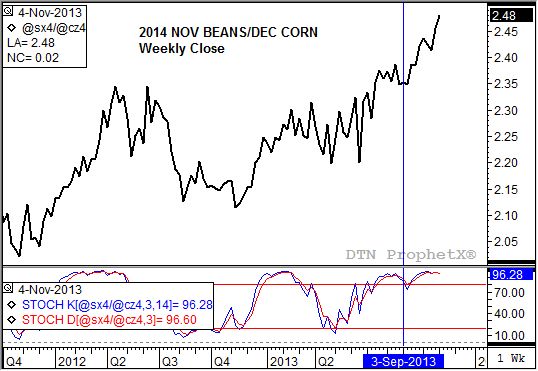

As the 2013 harvest winds down, attention quickly shifts to 2014 planting season and what the future may hold for U.S. corn and soybeans. And given the trend of the Nov bean/Dec corn ratio spread since the beginning of September, this winter could see one of the more heated fights for acres on record.

As the weekly close chart shows, Nov beans (2014) are priced almost 2.5 times more than Dec corn (2014). In years gone by, the 2.5/1 level was assumed to be the breaking point between planting more soybeans (above this level) or more corn (below this level). However, since 2006 corn planted acres have expanded from 78.3 million to this year's estimated 97.4 ma, an increase of 24% in a relatively short period of time. Corn's strength in relation to soybeans has lowered the mid-point of the five-year price distribution range to 2.25/1.

But 2014 could bring about an end to the larger corn acres trend. Early talk from private analytical firms is projecting a decrease of 5 million to 6 million acres, with much of that area possibly going to soybeans. If this becomes a reality then the strength of the November soybean contract has already done its job.

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

If we analyze the trend of the spread like any other market, there are signs that the direction could soon change. For starters, the trend has been almost straight up since the first week of September despite weekly stochastics showing the trend to already be in a sharply overbought situation.

Do these factors taken together mean the spread should automatically reverse itself and turn down? No, but it does indicate that traders and producers should both proceed with caution. Going back to the five-year price distribution range, the 2.49/1 level puts the spread in the top 13% based on weekly closes. This range takes into account the spike high to 3.18/1 seen in August 2009.

From a technical point of view the spread could be nearing its peak. Fundamentals that continue to favor more soybeans though, are another matter entirely.

To track my thoughts on the markets throughout the day, follow me on Twitter: www.twitter.com\DarinNewsom

Commodity trading is very complicated and the risk of loss is substantial. The author does not engage in any commodity trading activity for his own account or for others. The information provided is general, and is NOT a substitute for your own independent business judgment or the advice of a registered Commodity Trading Adviser.

Comments

To comment, please Log In or Join our Community .