Sort & Cull

USDA's On-Feed Report Interrupts Bullish Cattle Market

Editor's note: DTN Livestock Analyst ShayLe Stewart will be out of the office for a few weeks. We will continue to update her Sort and Cull blog with livestock market content. Please send any questions or comments to Editor-in-Chief Greg Horstmeier at greg.horstmeier@dtn.com.

**

To say that the U.S. cattle market has been bullish in 2023 is a bit of an understatement. The year started with 89.25 million cattle and calves in inventory, the lowest since 2015. More importantly, drought conditions were so harsh in 2022 and feed was so expensive that heavy liquidation of beef cows took place. At the start of 2023, only 28.9 million beef cows were in inventory, the lowest since 1962. By July 1, the number of calves under 500 pounds totaled 26.3 million, 3% less than the previous year.

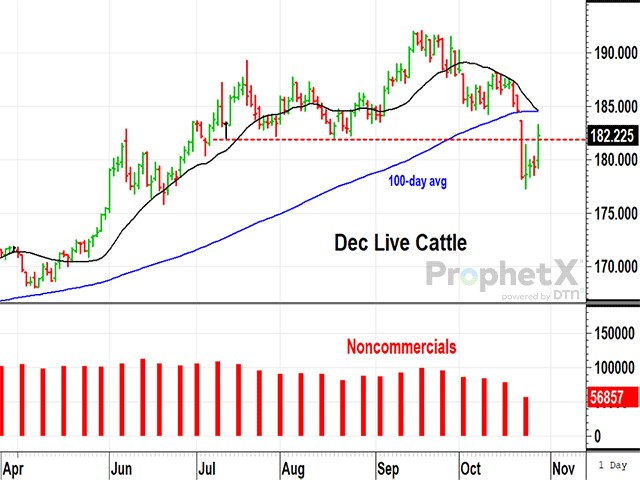

Long before the tough conditions of 2022, the cash live cattle market had been recovering from the challenges related to the onset of COVID-19. Negotiated live cattle hit a low near $96 per hundredweight in July 2020 and started gradually climbing higher as early fears eventually subsided. By the start of 2023, cash live cattle were up to $158 and eventually hit a high of $190 in June, the highest price live cattle ever traded. Speculative interest in the long side of cattle ebbs and flows, but spec positions were heavily net long through most of 2023, at 99,481 contracts as recently as early September.

Since June, cash live cattle have traded sideways, holding firmly above $184. On Oct. 20, USDA reported 11.580 million head of cattle on feed as of Oct. 1, more than expected after placements were up 6% from a year ago, also more than expected. The Oct. 23 response was harsh as December cattle futures closed down $6.27 on higher volume. Clearly, specs were cutting back their long positions. The Oct. 27 CFTC report showed noncommercial net longs fell from 78,307 to 56,857 as of Oct. 24.

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

The interesting question was how the cash market would respond the week following USDA's bearish on-feed report. As DTN reported Friday, Oct. 26, northern trade developed first, ranging from $287 to $292 with most near $290, $4 lower on the week. Southern trade was more patient, however, hanging on for roughly steady trade between $183 to $185.

Even though October's placements were up, before any significant herd expansion can take place, beef cows will have to be held out of slaughter, but there is no evidence of that happening yet. USDA said there were 4.635 million heifers and heifer calves on feed as of Oct. 1, 60,000 more than there were a year ago at this time. For that reason, it is difficult to see anything too bearish ahead for cattle prices if consumer demand holds up for beef.

USDA's report on Oct. 30 will show negotiated volume for the previous week, but the prior week's trade was bullishly impressive with packers taking over 100,000 cattle on a negotiated basis, wanting 73,910 within 14 days. Consumer demand for the week ending Oct. 27 remained impressive as choice boxed beef prices ended the week a little higher, at $307.57. The slaughter pace is also staying active with USDA estimating 636,000 cattle slaughtered for the week ending Oct. 27.

Aside from Monday's response to heavy spec selling, it is difficult to see anything that has significantly changed as far as the cattle market is concerned. Time will tell if packers have an easier time procuring cattle, now that more are on feed, but I doubt their job has gotten any easier. Specs may still be nervous about the number of cattle in feedlots, but in this market, I suspect cash trade will continue to hold steady to higher in the weeks ahead. It shouldn't be too surprising that Monday's close of $178.35 in December cattle was already up to $182.22 on Friday.

**

Comments above are for educational purposes only and are not meant as specific trade recommendations. The buying and selling of commodities, futures or options involve substantial risk and are not suitable for everyone.

Todd Hultman can be reached at Todd.Hultman@dtn.com

Follow him on X, formerly known as Twitter, @ToddHultman1

(c) Copyright 2023 DTN, LLC. All rights reserved.

Comments

To comment, please Log In or Join our Community .