Sort & Cull

USDA Forecasts 4.6% Drop in Livestock Cash Receipts but Higher Income for Cattle and Calf Producers in 2023

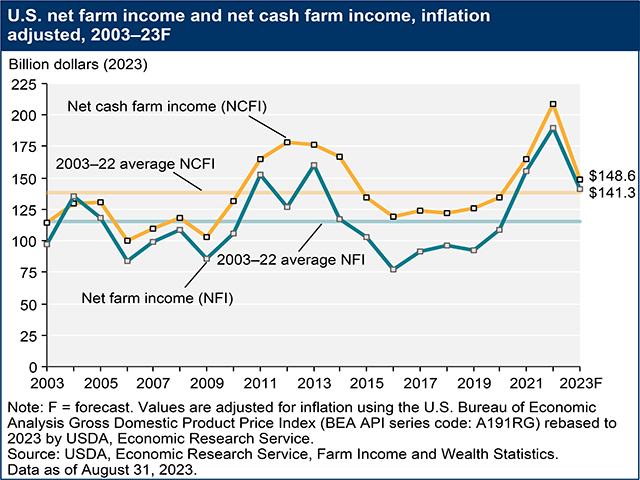

OMAHA (DTN) -- For the first time in five years, USDA forecasts national net farm income will fall nearly 23% in 2023, coming down from a record high in 2022.

Net farm income, defined by USDA as "a broad measure of profits," has risen each of the past five years, but will come down $41.7 billion in 2023 to $141.3 billion in 2023. That's a 22.8% decline from 2022's record of $183 billion.

The forecast projects farm cash receipts will fall 4.3% overall to $513.6 billion while expenses have risen 6.9% to reach $458 billion. Government payments are forecast to fall $2.9 billion, or 19%, as well.

The report comes out as Congress is expected to draft a new farm bill this fall.

PRODUCER GROUPS ON FARM BILL

Farm groups at the Farm Progress Show last week in Decatur, Illinois, were focused on protecting crop insurance in the farm bill. However, they also want to see adjustments in commodity programs. The farm income report shows the Title 1 programs, Agricultural Risk Coverage (ARC) and Price Loss Coverage (PLS), are projected to pay out a combined $42.6 million in 2023, a decline of $287 million from 2022. ARC and PLC right now are a small sliver of the farm safety net.

Stronger market conditions in recent years have dramatically lowered the need for safety-net programs. Farm subsidies continue to decline after peaking at a record $45.6 billion in 2020, driven by the pandemic. Government payments have steadily ticked downward to $15.6 billion in 2022, then falling to $12.6 billion in 2023. The bulk of the aid, about $7.8 billion, is expected to come from ad-hoc assistance and not traditional farm-bill programs.

Minnesota farmer Harold Wolle, first vice president of the National Corn Growers Association, noted NCGA delegates earlier this summer voted for a mandatory update of base acres to improve the safety net.

"We've been fortunate in the last few years that we haven't had to use that safety net," Wolle said. "We write a farm bill for when times are bad and when those bad times come people are going to remember what base acres are and how they play into that safety net and realize that an updated base is appropriate."

Just as important, Wolle said NCGA wants to see more funding go to trade programs -- Foreign Market Development and Market Access Program, known as FMD and MAP. Those programs have had relatively flat budgets, but commodity groups say they are vital to helping expand trade.

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

"Trade is all important and these programs need more dollars," Wolle said.

North Dakota farmer Josh Gackle, vice president of the American Soybean Association, noted farm groups are all over the board when it comes to updating base acres. ASA is advocating for a voluntary base acre update. "Every farm is different, every state is different and every region is different, but the opportunity to do so should be there if it works for your farm," Gackle said.

ASA would like to see an increase in reference prices so that ARC/PLC payments would kick in if there is a dramatic decline in market conditions. Right now, soybean prices would have to fall more than $5.50 a bushel for PLC payments to begin.

"We'd like to see those programs be more predictable and reliable for the farmer," Gackle said. "What we've seen recently is kind of ad-hoc programs that we can't depend on. You can't use that when you are trying to work with your banker. You can't just hope for an ad-hoc program if you have a bad crop. What you'd like to see is a strong safety net, a Title 1 safety net, with reference prices that reflect the reality that you're facing."

FARM INCOME SUMMARY

Crop receipts are forecast at $267 billion, to decline $11.2 billion, or about 4%. Farmers who grow corn, soybeans, wheat and cotton are projected to see lower income while vegetable/melon farmers are forecast to have higher income.

Corn farmers are expected to see receipts fall $8.5 billion, or 9.6% because of lower prices.

Soybean receipts are forecast to decline $5.4 billion, or 8.6%, because of lower expected prices and quantities.

Cotton receipts are expected to decline $1.6 billion.

Hay receipts are expected to increase about $700 million, or 7.4%.

In livestock, cash receipts look to fall $11.9 billion, or 4.6%. Cattle and calf producers are projected to have higher incomes, along with turkey growers. Dairy farmers, pork producers, and producers of broilers and eggs are all expected to have lower incomes.

EXPENSES

Farm production expenses will reach $458 billion in 2023, up 6.9%, though USDA still lists 2014 as the highest on record when adjusted for inflation.

USDA noted interest expenses are projected to jump $9.2 billion to $33.3 billion in 2023, an increase of 38.1% for producers. "This reflects expectations that the total debt and interest rates will rise in 2023," USDA stated.

Feed expenses are forecast at $86.4 billion and are the single largest expense category, up 3.2% from 2022.

Labor expenses are projected at $44.1 billion, up 5.3% from a year ago.

Other livestock and poultry expenses beyond feed are forecast to increase 22% to $42.4 billion, driven heavily by higher prices for cattle and calves.

Fertilizer expenses are projected at $36.4 billion, down slightly from 2022's record of $36.85 billion.

Fuel and oil expenses are expected to drop 13.1% to $16.1 billion with lower diesel, gasoline and natural gas prices.

For the full USDA report, go to https://www.ers.usda.gov/….

Chris Clayton can be reached at Chris.Clayton@dtn.com

Follow him on Twitter @ChrisClaytonDTN

(c) Copyright 2023 DTN, LLC. All rights reserved.

Comments

To comment, please Log In or Join our Community .