Sort & Cull

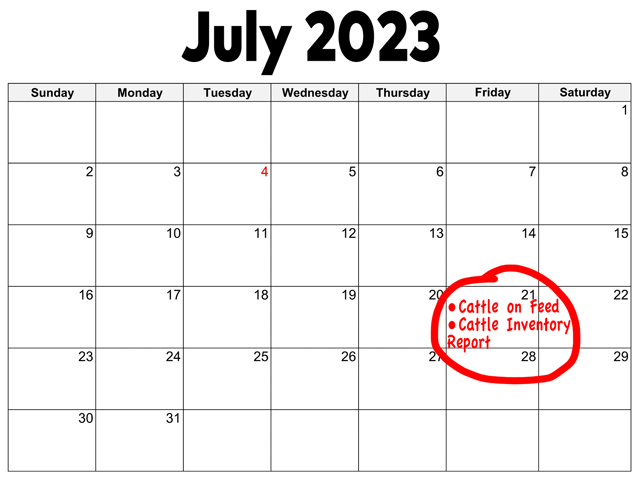

New Cattle Inventory and Cattle on Feed Reports This Friday

We may be living what will be remembered as the "good ol' days" over the next three to six years. It's common to hear producers talk about the market highs of 2014-15 with a nostalgic tone in their voice, as those prices --before this year -- were all-time highs for the fat cattle market. But, as we continue to press onward into the second half of this year, the cattle complex's wildly ambitious nature hasn't settled down; if anything, it's only grown stronger and bolder.

The fact that feedlots were willing to wait until late last Friday afternoon (July 14) to trade cattle is a bold statement. Packers desperately want to get a foothold on the cash cattle market, but feedlots aren't making it easy. With feedlots' commitment to marketing their cattle to the absolute best of their abilities, true price discovery has again been attained in the cattle market. It's not only helping the live cattle and cash cattle markets trade higher, but the feeder cattle market is trading higher too.

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

This week will be a busy one for the cattle complex. On Friday, July 21, not only will the market see the monthly Cattle on Feed report, but it will also get to see the midyear Cattle Inventory report, which is the report the market will likely spend more time analyzing.

The midyear Cattle Inventory report should paint a bullish trajectory for the market, just like it did back in January. As of July 1, the market has processed 1,744,578 head of beef cows this year. Compared to 2022, this year's beef cow slaughter is down 11%. However, compared to 2021, 2023's beef cow slaughter is up 1% and, compared to the market's five-year average, 2023's beef cow slaughter is trending up 3%.

Needless to say, producers haven't felt confident enough to retain females, and that conclusion should only strengthen the market's bullish tone.

Stay tuned for what Friday has in store!

ShayLe Stewart can be reached at ShayLe.Stewart@dtn.com

(c) Copyright 2023 DTN, LLC. All rights reserved.

Comments

To comment, please Log In or Join our Community .