Canada Markets

Why 18-Year-Low Ending Stocks in Corn Exporting Countries Should Be on Everyone's Radar

On Jan. 10, the USDA will issue its final crop production estimates, the latest World Agricultural Supply and Demand Estimates (WASDE) update and Dec. 1 stocks report. The data will surely move the corn market and set the tone for the coming year. Not to be overlooked should be the world situation, considering multi-year low levels of ending stocks in both exporting and importing countries.

With prices tending to move based on who is more motivated -- buyers or sellers -- corn markets should be entering a phase where sellers hold the edge. With major exporting nations expected to have combined ending stocks at lows not seen since 2006-07, while importing countries allowed their ending stocks to decline to the lowest level since 2012-13, buyers should be more motivated than sellers -- especially if geopolitical tensions escalate and food security becomes a concern.

Don't let yourself be fooled by the headline number of large world corn ending stocks -- the fact China holds 68.9% yet imports corn annually should be comforting to no one. Not only will those stocks be kept from entering the export market, the accuracy of the data is also hard to verify. Even the USDA came to that conclusion and began publishing estimates of "World Less China" years ago.

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

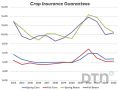

As of the December WASDE update, major exporting countries (Argentina, Brazil, Russia, South Africa and Ukraine) combined are expected to hold 7.99 million metric ton (mmt)of corn at the end of 2024-25. That is down sharply from 15.06 mmt the previous year and 18.47 mmt in 2022-23. Stocks-to-use ratios paint a similar picture at 6.17% for 2024-25 versus 11.83% the previous year and 15.35% in 2022-23. You must go back to 2006-07's 6.497 mmt to find tighter ending stocks but interestingly -- not stocks to use -- at 9.8% that year, given the lower level of use. All suggest little need to be an aggressively motivated seller.

It is worth noting that record production totals for Argentina and Brazil are factored into estimates with the larger Brazilian corn production -- with the second (safrinha) crop not even planted yet. Expanding dryness and stressful forecasts for Argentina and Southern Brazil may affect those estimates eventually. Heavy rainfall in central and northern Brazil may result in delays in planting the safrinha corn crop, leaving it pollinating in a traditionally stressful period of heat and dryness.

For major importing countries (Egypt, European Union, Japan, Mexico, Southeast Asia and South Korea), the story is not much more comforting. On a combined basis, they have allowed their ending stocks to shrink to the lowest level since 2012-23. At an estimated 18.91 mmt for 2024-25 compared to 20.53 mmt the previous year and 20.78 mmt for 2022-23, the changes aren't as dramatic but still noteworthy. For comparison's sake, the 20-year high was 22.972 mmt set in 2015-16 while the low was 12.716 mmt set in 2012-13. Again, those countries are more of a motivated group should food security become an issue.

The market has been taking this seriously for some time with the March futures nearly $0.60/bushel off the August seasonal lows. According to the Commitments of Traders data, money managers certainly have been. They have gone from a record net short of 353,983 contracts (1.77 billion bushels) during the week ending July 8 to 228,806 contracts (1.144 bb) net long as of Dec. 31, 2024. With the record net long being 429,189 contracts set September 2010, plenty of buying could be seen yet should developments warrant.

Interesting enough, commodity index traders have also taken note and have been actively buying as a hedge against inflation since August. They are net long 384,485 contracts (1.922 bb) as of Dec. 31 after nearing a recorded low of 214,206 contracts in August. Their record high position of 493,736 contracts was set in April 2024, declining from there once the Fed declared war on inflation. More can be found at https://www.dtnpf.com/….

Taking a step back to focus on Friday's report, short-term price direction will be much more affected by any surprises. Trade will look to see if yields fall further, taking production with it, or not. If exports increase further, given their impressive pace to date and the topic covered here. If ethanol use will increase with its exceptional grind pace. If the Dec. 1 stocks report implies higher than previously estimated feed use given exceptional profit potential in the livestock sector. Time will tell, but the details contained within this analysis should provide long-term underlying support.

Mitch Miller can be reached at mitchmiller.dtn@gmail.com

Follow him on social platform X @mgreymiller

(c) Copyright 2025 DTN, LLC. All rights reserved.

Comments

To comment, please Log In or Join our Community .