Canada Markets

Statistics Canada Estimates Total 2024 Seeded Fields Crops at 78.2 Million Acres

Statistics Canada's first seeded acre estimates for 2024 were released Monday morning. As indicated in earlier posts, this report marks the second year where producer surveys were conducted in the mid-December through late-January period, as part of the 2023 Field Crop Survey-December survey. One change made this year is the time frame for the data release was tightened significantly from last year's April 26 release date, although concerns still remain over the possibility for acreage changes to take place between the Dec/Jan survey period and spring.

Statistics Canada's estimate for total area seeded to field crops is seen at 78.2 million acres, down from the record 78.4 million calculated for 2023. Estimated summer fallow acres are forecast to dip to a record low of 1.209 million acres.

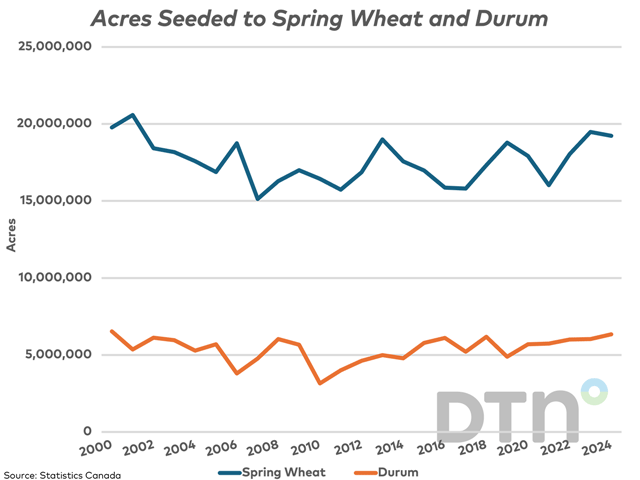

Canada's acres seeded to all-wheat are forecast to tick 0.1% higher in 2024 to 27.045 million acres, 7.3% higher than the five-year average and the largest area seeded since 2001. This was higher than the average of pre-report estimates as reported by Reuters of 26.7 million acres, coming in closer to the upper end of the range of estimates. An increase in forecast acres seeded to durum is shown to offset a drop in both spring and winter wheat acres.

Spring wheat acres are forecast to fall by 240,000 acres to 19.235 million acres, down from the highest acres seeded in 2023 since 2001. This area is down 1.2% from one year ago and 6.6% higher than the five-year average. The largest change is a 3.1% drop in acres in Saskatchewan, while both Manitoba and Alberta are forecast to increase acres.

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

A hike in durum acres, forecast to rise by 310,300 acres or 5.1% to 6.344 million acres, would result in the largest area seeded since 2000 and could be viewed as a surprise. The average of pre-report estimates was looking for a marginal cut in acres. While global stocks are forecast at the lowest in decades, the southern Prairies remain dry and Canada struggled to compete with supplies from Turkey and Russia in 2023-24.

As widely expected, producers are forecast to trim the area seeded to canola in 2024 to 21.394 million acres, only slightly below the area seeded in 2022, but still the lowest area seeded in four years. This is 3.1% below the area seeded in 2023 and 0.7% below the five-year average. Today's estimate resulted in a deeper cut than seen in pre-report estimates, with the average estimate at 21.85 million acres. The market clearly sees this as bullish; at the time of writing, the November contract is up $6.60/mt, extending Friday's move above the contract's 50-day moving average. Friday's close above the 50-day moving average was the first since Nov. 21. This cut in acres is due to a 4.9% cut in Saskatchewan while Alberta producers are forecast to cut by 2.4%. Manitoba is the exception, forecast to increase acres by 2.4%. While the canola crush is forecast to rise substantially on the Prairies, canola exports in 2023-24 have disappointed, largely due to a sharp drop in exports to China.

Barley acres are forecast to fall by 2.5%, to 7.134 million acres, while down 5.3% from the five-year average. The largest cuts are seen in Manitoba at 4.5% and in Alberta at 3.7%, while this cut was largely as expected in pre-report estimates. Despite a drop in production seen in 2023, barley stocks are still forecast to increase year-over-year in 2023-24 due to competition from U.S. corn, while this competition is likely to continue.

As expected, oat acres are forecast to rise by 21.6% to 3.072 million acres, while still down 12.8% from the five-year average. Ending stocks for 2023-24 are estimated to fall close to historic lows, while lower input costs make oats an attractive option for many.

Lentil acres on the Prairies are forecast to rise by 4.4% to 3.829 million acres, down 5.2% from the five-year average while below the average of pre-report estimates of 4.2 million acres. This follows last year's seeded area, which was the lowest area seeded in nine years. This is also below AAFC's current estimate of 3.9 million acres.

Dry pea acres are forecast to rise by 2.4% to 3.122 million acres, near the lower end of pre-report estimates and well-below the average of pr-report estimates of 4 million acres. This area is 17.2% below the five-year average, and slightly below AAFC's January estimate. The pulse crop estimates will remain a topic for ongoing debate; recent movement of yellow peas to India due to their elimination of import tariffs may have swayed opinions since the producer surveys were completed.

Canada's soybean acres are forecast at 5.582 million acres, down 0.9% from last year and 4% higher than the five-year average. This area is very close to the average of pre-report estimates. While Ontario is forecast to increase acres by 4.3% to 3.038 million acres and accounts for 54% of Canada's acres, Quebec is forecast for a 3.9% drop and Manitoba producers are forecast to lower acres by 7.2%.

Corn acres across the country are forecast to increase by 1.6% to 3.885 million acres, close to the average of pre-report estimates. This would be a record area, up 5.5% from the five-year average. Ontario producers are forecast to bump acres marginally higher, or 0.2% to 2.265 million acres, accounting for 58% of the country's corn for grain area. Quebec producers are forecast to increase acres by 5.4%, while Manitoba producers are forecast to increase acres by 5.8% to a record 585,800 acres.

Cliff Jamieson can be reached at cliff.jamieson@dtn.com.

Follow him on X, formerly known as Twitter, @CliffJamieson.

(c) Copyright 2024 DTN, LLC. All rights reserved.

Comments

To comment, please Log In or Join our Community .