Canada Markets

AAFC's Latest Wheat Forecast: A Closer Look

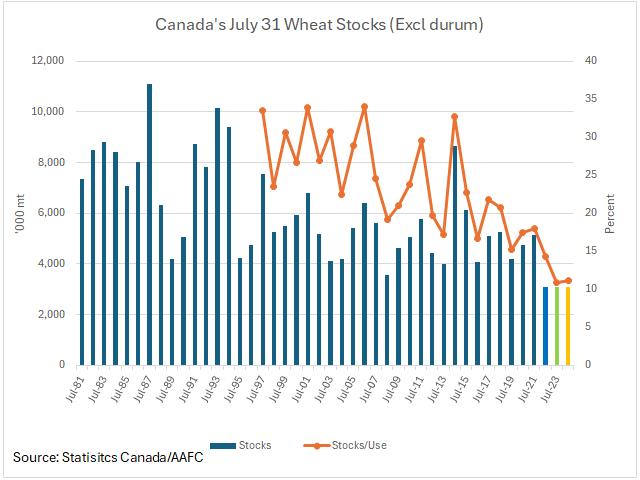

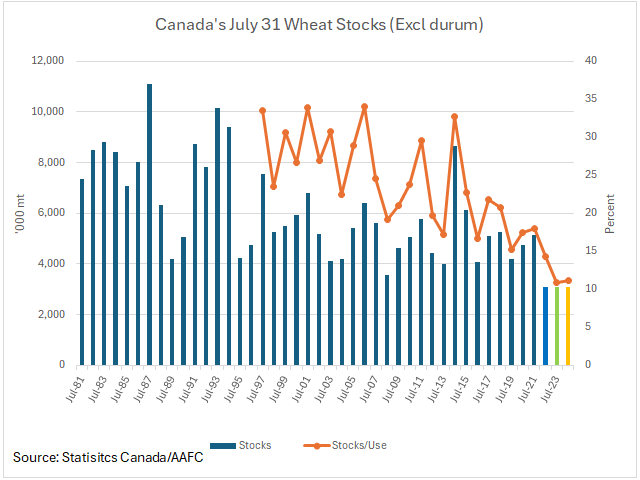

Agriculture and Agri-Food Canada's February estimates included a 400,000-metric-ton lower revision in 2023-24 ending stocks of wheat (excluding durum) to 3.1 million metric tons (mmt). This is tied to a modest lower revision to 2023-24 crop year supplies which must be linked to its estimate of 2022-23 ending stocks, along with an upward 250,000-mt increase in its export forecast to 20.250 mmt.

At 3.1 mmt, ending stocks remain similar to the 3.093 mmt in 2021-22 and 3.103 mmt in 2022-23. It remains below the 4.062-mmt five-year average. It would seem the 3 mmt-to-3.1 mmt level is viewed as a rock-bottom inventory, with expectations that stocks will remain flat for a third year.

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

The upward revision in exports may be viewed as a conservative estimate. As of week 28, the 11.492 mmt of licensed exports were 588,000 mt ahead of the steady pace needed to reach the revised forecast. Based on current official estimates of supplies, the pace of exports remains well ahead of the pace needed to reach the revised forecast, even when unlicensed exports and the export of flour are excluded. Perhaps the pace of exports is poised to slow further during the balance of the crop year.

When the historical pace of wheat shipments is considered, we see on average during the past five years that 50.1% of total crop year exports were achieved as of the Canadian Grain Commission's week 28 report, a pace of movement that projects forward to total exports of 22.9 mmt for the current year, or more that the current estimate of supplies will allow. During the past three years, an average of 52% of total crop year exports were executed as of week 28, a pace that projects forward to crop year exports of 22.058 mmt of exports.

If the 3 mmt level is the lowest that stocks can be pushed, then either the pace of exports will slow in the weeks ahead or the official production estimate will be revised higher.

Cliff Jamieson can be reached at cliff.jamieson@dtn.com.

Follow him on X, formerly known as Twitter, @CliffJamieson.

(c) Copyright 2024 DTN, LLC. All rights reserved.

Comments

To comment, please Log In or Join our Community .