Canada Markets

AAFC Revises Canola Forecast for 2023-24

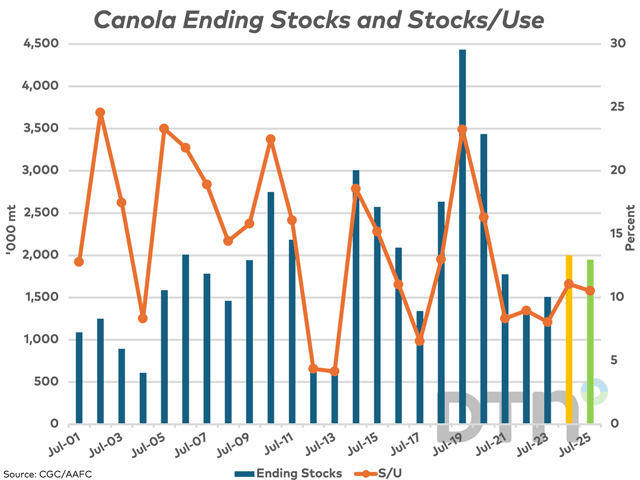

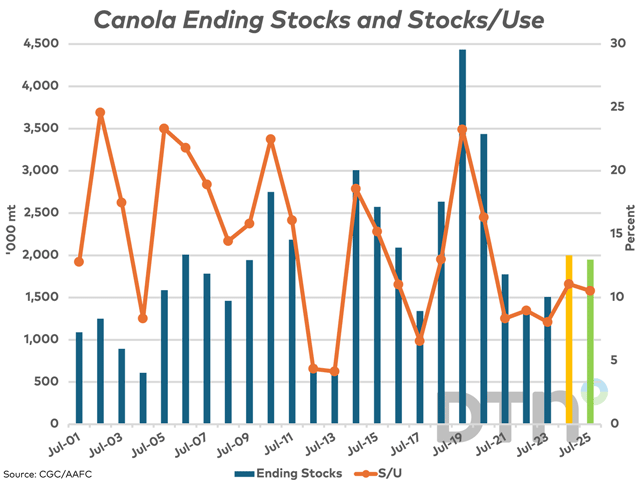

For the first time in six months, Agriculture and Agri-Food Canada's February forecast included a lower revision in the forecast for 2023-24 canola exports to reflect the slower movement faced, resulting in a sharply higher forecast for 2023-24 ending stocks.

The government forecast for exports was revised 700,000 metric tons (mt) or 9% lower in the February Canada: Outlook for Principal Field Crops report to 7 million metric tons (mmt). Smaller revisions were also made in other areas, with imports revised 150,000 mt higher while the Feed, Waste and Dockage estimate was increased by 300,000 mt. This was the first revision in AAFC's export forecast since September, or in six months, despite a slow pace of movement experienced since early in the crop year.

The 7 mmt export forecast would signal the lowest exports since the 2021-22 drought year, while the five-year average is 8.6 mmt. As of the Canadian Grain Commission's week 28 Grain Statistics Weekly, exports of 3.1702 mmt are down 32.4% from the previous crop year and 36.8% below the five-year average.

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

Concerns remain that this lower revision will be followed by more similar actions. During the past five years, an average of 59.3% of total crop year exports were realized as of the week 28 licensed export volume, while this average pace would project forward to crop year exports of 5.3 mmt. The slowest pace of movement during the past five years was seen in the 2019-20 crop year, when 49% of total crop year exports were achieved as of week 28, a pace that projects forward to crop year exports of 6.5 mmt.

Also, when one considers the steady pace of movement needed to reach the revised forecast of 7 mmt, cumulative exports are roughly 599,000 mt behind the steady pace needed to reach the revised forecast.

Given current official estimates of stocks and 2023 production along with AAFC's revised export forecast, ending stocks would swell by 32.8% in 2023-24 to 2 mmt, the largest volume reported in Statistics Canada data in four years. AAFC's early forecasts for 2024-25 show a modest drop in stocks of 50,000 mt to 1.950 mmt.

Canola traders paid little attention to this report on Feb. 20, with prices settling higher for a second session. The May contract closed $18.40/mt higher than the contract low reached on Feb. 16.

Cliff Jamieson can be reached at cliff.jamieson@dtn.com.

Follow him on X, formerly known as Twitter, @CliffJamieson.

(c) Copyright 2024 DTN, LLC. All rights reserved.

Comments

To comment, please Log In or Join our Community .