Canada Markets

Dry Pea Exports as of Week 28

The Canadian Grain Commission reported dry pea exports of 135,300 metric tons (mt) through licensed grain facilities in week 28, down from the 152,700 mt shipped in the previous week. These two weeks represent the second and third largest weekly volumes shipped this crop year, below the 199,600 mt shipped in week 6.

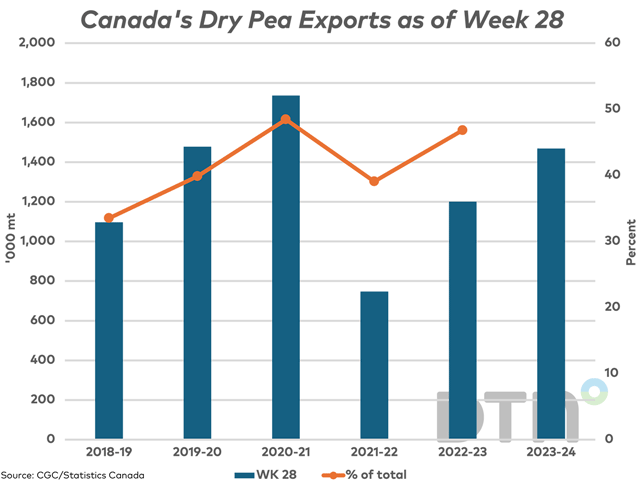

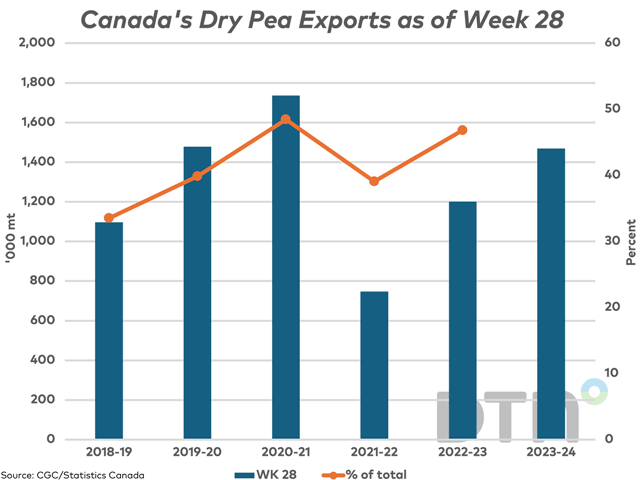

Dry pea exports over the first 28 weeks total 1.4694 million metric tons, the largest volume shipped in three years for this period, up from 1.2 mmt in 2022-23 and above the five-year average of 1.252 mmt.

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

The brown line with markers on the attached chart represents the percentage of total crop year exports realized as of week 28 over the past five crop years, ranging from a low of 33.5% in 2018-19 to a high of 48.5% as of 2020-21. On average over the five years (2018-19 to 2022-23), 41.5% of total crop year exports have been achieved as of week 28.

While not shown, the current pace of exports have reached 66.8% of the current Agriculture and Agri-Food Canada (AAFC) export forecast of 2.2 mmt, a significantly higher percentage than seen in any of the past five years. This week's International Grains Council has estimated Canada's exports for 2023-24 at 2.3 mmt, or 100,000 mt higher than AAFC, while based on current production estimates, would see ending stocks fall to 170,000 mt or 5.7% of use and would be the tightest seen since 2007-08 and close to the tightest seen since Statistics Canada started reporting pea data in 1999.

Shippers are expected to remain active over the upcoming weeks, with India's 50% duty exemption on imported peas to remain in place until March 31. As of week 28 or the week ending Feb. 11, producers have delivered 2.0075 mmt of peas into the licensed handling system, which is up 156,800 mt from a year ago despite the 2023 harvest estimated at 2.609 mmt, down 814,000 mt from the previous year.

Commercial stocks as of week 28 are shown at 334,400 mt, down 13% from the five-year average while reflecting the lower supplies for 2023-24 and a favourable pace of shipping. At the same time, 68.5% of this volume is seen in country elevators, which compares to the five-year average of 77.7%, signaling the urgency to move product prior to the end of March.

Cliff Jamieson can be reached at cliff.jamieson@dtn.com.

Follow him on X, formerly known as Twitter, @CliffJamieson.

(c) Copyright 2024 DTN, LLC. All rights reserved.

Comments

To comment, please Log In or Join our Community .