Canada Markets

The Spot Canadian Dollar Reaches a 2024 Low

The spot Canadian dollar sank 71 basis points to $0.7361 CAD/USD on Feb. 13, the largest one-day plunge since March 7, 2023, or almost one year.

Stronger-than-expected U.S. inflation data released on Tuesday was the catalyst in Tuesday's move, potentially pushing back the notion of rate cuts in the first half of the year.

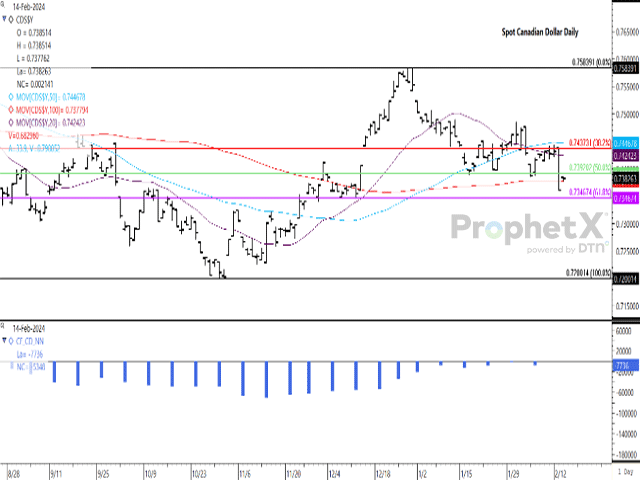

As seen on the attached chart, the spot dollar reached its weakest trade against the USD since Dec. 13, or two months. The move saw the exchange rate move below its 100-day moving average on Feb. 13, as seen by the horizontal red line, which may signal a change in trend.

As well, Tuesday's move saw the 50% retracement of the move from the Oct. 31 low to the Dec. 29 high, shown by the horizontal green line at $0.7392 CAD/USD. This could lead to a further slide to a test of the 61.8% retracement of $0.7347 CAD/USD, a level that acted as support three times from Nov. 30 through Dec. 12 as the loonie paused its uptrend in favour of sideways trade.

On Wednesday, the spot dollar bounced back from Tuesday's low to close above the contract's 100-day moving average, up 21 basis points to $0.7383 CAD/USD.

The lower study shows the noncommercial net-futures position as reported in weekly data from the CFTC. While this group continues to hold a bearish net-short position, the size of this position over the past five weeks could be viewed as somewhat neutral in comparison to the size of the net-short held over the last half of 2023.

Cliff Jamieson can be reached at cliff.jamieson@dtn.com.

Follow him on X, formerly known as Twitter, @CliffJamieson.

(c) Copyright 2024 DTN, LLC. All rights reserved.

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

Comments

To comment, please Log In or Join our Community .