Canada Markets

Canadian Durum Stocks Sharply Lower as Price Sinks Lower

Thursday's Statistics Canada Dec. 31 stocks of durum were reported at 2.959 million metric tons (mmt). This is close to the volume arrived at from a quick calculation made based on Statistics Canada's recent estimates. This includes the July 31, 2023 carryout of 409,000 metric tons (mt); its 2023 production estimate of 4.045 mmt; the Canadian Grain Commission's reported demand for the period; Statistics Canada's reports of domestic grain milled; and a rough estimate of domestic demand based on Agriculture and Agri-Food Canada's estimate for the crop year.

This volume is down 27% from one year ago and 31.6% below the five-year average. This comes at a time when AAFC is quoting International Grains Council data that shows global durum ending stocks for 2023-24 at 5 mmt, the lowest in more than 30 years.

As shown on a chart for the Feb. 8 Canada Markets Blog based on Statistics Canada historical estimates, the Dec. 31 stocks estimate of 2.959 mmt remains higher than the 2.533 mmt estimate for Dec. 2021, while the next lowest estimate is seen for December 1988 of 2.024 mmt. The Dec. 31 estimated volume is the second-lowest volume reported in 35 years. As shown on the chart, the most recent 10-year average (2013-14 to 2022-23) is 4.6 mmt as of Dec. 31, while the five-year average is 4.3 mmt (2018-19 through 2022-23).

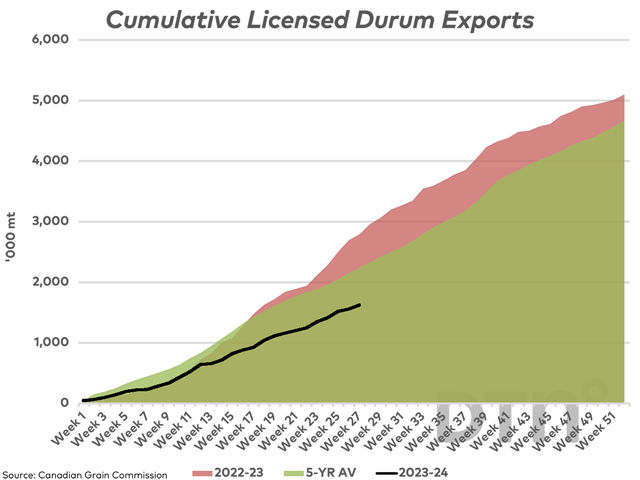

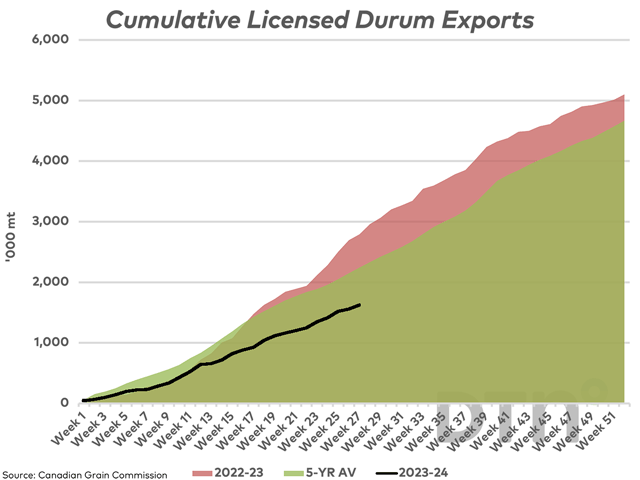

While stocks are tight, it appears that the current AAFC forecast for 2023-24 remains on track based on current estimates. When you consider the volume of durum exported through licensed channels during the first 27 weeks of the crop year, we see that on average over five years, 48.5% of total crop year exports are achieved as of week 27. This is a pace that projects forward to crop year exports of 3.355 mmt, only slightly higher than AAFC's current forecast of 3.2 mmt.

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

Despite the tighter stocks, pdqinfo.ca price data shows southern prairie bids falling from $18.02/mt to $21/mt across the four southern prairie regions monitored this week, ranging from western Manitoba through southern Alberta. Cash bids are seen approaching $400/mt or $10.89/bu, while longer-term support on PDQ's cash market chart lies at $390/mt or $10.61/bu.

This week saw unwelcome news in the global trade when Tunisia purchased 100,000 mt of durum for March/April delivery. The trading house Casillo was awarded the bulk of this tender, while it is believed will be filled with Russian product. The reported price is roughly $30/mt USD lower than their last tender just three weeks earlier, setting a new level for trade that will spill over into surrounding markets.

When it comes to old crop, watch for opportunities as buyers step up to cover some of their earlier sales or to fill the last few cars on their train.

When it comes to new crop, AAFC has forecast an even lower average price for 2024-25 than seen for the current crop year, down $75/mt to $400/mt in their first stab at forecasting the next crop year. The Canadian Prairies remain dry, while media reports this week indicated that France planted its smallest crop of durum since 1997 in 2023, while could be even smaller in 2024.

Cliff Jamieson can be reached at cliff.jamieson@dtn.com

Follow him on X, formerly known as Twitter, @CliffJamieson

Cliff Jamieson can be reached at cliff.jamieson@dtn.com.

Follow him on X, formerly known as Twitter, @CliffJamieson.

(c) Copyright 2024 DTN, LLC. All rights reserved.

Comments

To comment, please Log In or Join our Community .