Canada Markets

Durum Exports Continue to Lag

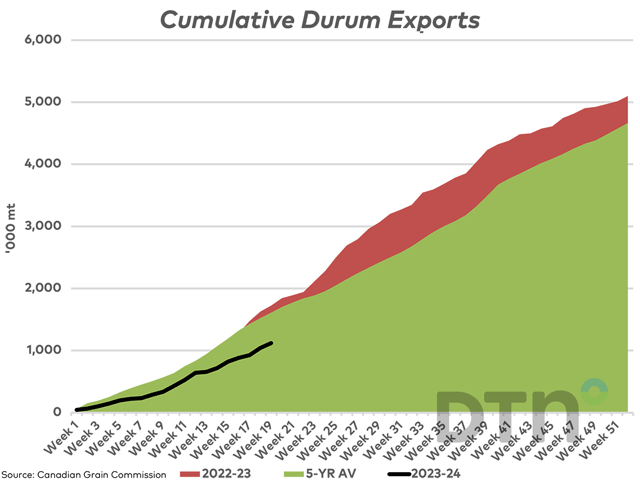

The Canadian Grain Commission reports durum exports in week 19, or the week ending Dec. 10, at 74,700 metric tons (mt), down from the previous week but above the volume needed for the week and a second straight week to reach the current Agriculture and Agri-Food Canada forecast of 3.3 million metric tons (mmt).

Cumulative exports as of week 19 are shown at 1.1184 mmt, behind the steady pace needed to reach the government's forecast for 2023-24 export demand. This is down 606,700 mt, or 35% from the same period last year and 483,420 mt, or 30.6% below the five-year average for this period, as seen on the attached chart. For the 19th week, the pace of exports has been behind that set in 2021 when drought sharply reduced durum production to 3.033 mmt, although this week's spread is the narrowest seen to date.

When the seasonality of durum exports is considered, we see that over the past five years, an average of 34.9% of total crop year exports have been achieved as of week 19. When the current pace is projected forward based on this historical pace, we see that projected exports are calculated at 3.205 mmt, close to the current 3.3 mmt forecast from AAFC. When this calculation is made based on the past three years, exports project slightly lower at 2.978 mmt, which compares to 2.716 mmt shipped in 2021-22.

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

The CGC reports commercial stocks of durum instore licensed facilities at 497,800 mt, down 30% from a year ago and 35.7% below the five-year average. A calculated 59% of commercial stocks are found instore country elevators, which is a higher percentage than the five-year average of 52% for this week, a sign of weak demand.

Competing supplies have made Canadian supply uncompetitive, but the situation bears watching. On Dec. 11, the Russian government released a government decree to ban durum exports until May 31, 2024, to protect tight supplies. In addition, Turkey's potential has remained in question. Weekly European data shows no imports from Turkey for two consecutive weeks but note that cumulative imports of 1.438 mmt from all sources are up 146% from one year ago.

This week, Tunisia tendered 75,000 mt for January shipment but a social media post on the reported price of $437/mt USD indicated "they clearly had non-Canadian ownership."

According to pdqinfo.ca cash data, prairie bids remain sideways near the lowest levels seen since July 2023 or near crop year lows. European durum on the Euronext is down EUR 2.50/mt over this week's trade to EUR 389.50/mt (March contract), while the lowest weekly close seen since the week of July 10. This price has breached the 61.8% retracement of the move from the contract's June low to July high, with potential chart support seen even lower at EUR 372.25/mt.

Wet conditions in western Europe have left producers struggling to plant winter crops, with official data from France showing winter durum acres planted at 506,555 acres, down 10.5% from a year ago and 15.7% below the five-year average. Despite this move, the September European durum contract fell by EUR 2.50/mt this week, a second week of modest weakness.

Cliff Jamieson can be reached at cliff.jamieson@dtn.com.

Follow him on X, formerly known as Twitter, @CliffJamieson.

(c) Copyright 2023 DTN, LLC. All rights reserved.

Comments

To comment, please Log In or Join our Community .