Canada Markets

AAFC Updates 2023-24 Forecasts

Agriculture and Agri-Food Canada's September Outlook for Principal Field Crops supply and demand tables incorporated Statistics Canada's recently released July 31 stocks estimates for all crops except corn and soybeans, along with the model-based production estimates, based on August model data.

Despite a higher seeded acres estimate of 78.182 million acres for all principal field crops, up 0.8% from the previous year, the harvested acre estimate fell by 0.7 percentage points from the previous year to 96.3% and yield fell by 13% to 2.77 metric tons/hectare (6.8 metric tons/acre). Production of principal field crops is forecast to fall by 12.599 million metric tons (mmt), or 13%, to 84.492 mmt. This drop in production compares to the 27.182 mmt drop realized in the 2021-22 drought year.

Canada is forecast to import 1 mmt more grain in 2023-24 to 4.179 mmt, while total supplies are forecast at 99.065 mmt, down 11.269 mmt or 10.2% from the previous year. Total exports are forecast at 45.519 mmt, down 8.096 mmt or 15%, while domestic use of principal field crops is estimated at 44.632 mmt, down 1.692 mmt or 3.7% from 2022-23.

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

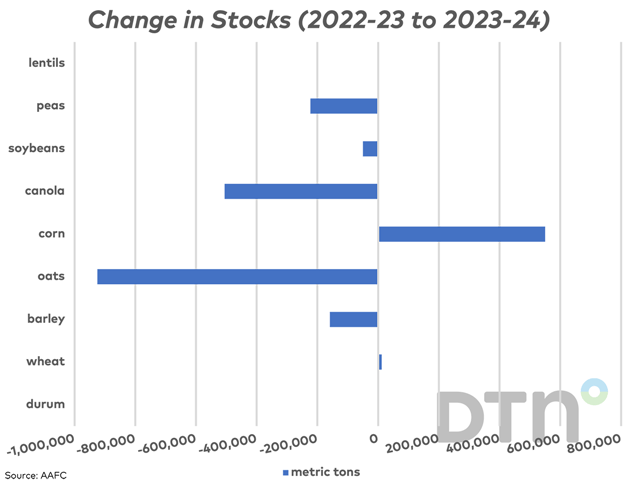

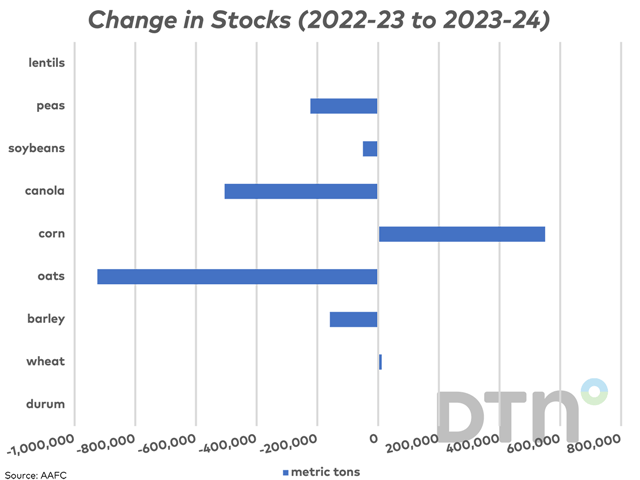

Ending stocks of all principal field crops as shown at 8.915 mmt, down 1.480 mmt or 14.2%. This would be the tightest stocks or all principal field crops seen in Statistics Canada data going back to the early 1980's.

Total supplies of all-wheat are forecast to fall by 4.519 mmt or 11.9% to 33.544 mmt. Exports of Canadian wheat are forecast to fall by 4.232 mmt or 16.6% due to lower supplies available, while domestic demand is reduced by a modest 302,000 mt. Stocks of both durum and wheat are forecast to rise modestly year-over-year, although durum stocks at 400,000 mt are forecast to remain close to the lowest since 1985-86 and wheat stocks of 3.2 mmt are forecast to remain close to the lowest in more than 40 years of Statistics Canada data.

Canola supplies are forecast to fall by 5.8% to 18.974 mmt, which would be the second-lowest crop year supplies estimated in 11 years. Demand is forecast to remain relatively close to the demand faced in 2022-23, with exports forecast to fall by a modest 248,000 mt to 7.7 mmt while domestic disappearance is reported to rise year-over-year by a modest 39,000 mt. Canola stocks are forecast to fall by roughly one-third to 1 mmt.

The largest drop in stocks seen on the attached chart is seen for oats. A sharp 35.8% drop in forecast seeded acres combined with a 21% drop in yield is forecast to offset a huge 1.275 mmt carry-in from the 2022-23 crop year. Oat supplies are forecast at 3.735 mmt, 1.846 mmt or 33% lower than the previous crop year. It is forecast that exports will fall by a modest 233,000 mt to 2.450 mmt, while domestic use, primarily feed use, will fall by 49.3%. Ending stocks are forecast to fall by 925,000 mt to 350,000 mt, close to the lowest levels on record.

As seen on the attached chart, the largest increase in stocks is seen for corn. A slightly higher seeded acres teamed with a slightly lower estimate yield by Statistics Canada is forecast to lead to increased production and supplies for 2023-24, although the official stocks estimate for Aug. 31 has yet to be released for the row crops. A lack of feed in Western Canada is expected to lead to a 900,000 mt increase in imports to 3 mmt, while crop year supplies are forecast at 19.582 mmt, up 198,000 mt from the previous crop year. Domestic use is forecast to increase by 648,000 mt, while exports are forecast to fall by 1 mmt, to 1.850 mmt from the record volume currently forecast for 2022-23. Ending stocks are forecast to increase by 550,000 mt to 2.2 mmt.

Cliff Jamieson can be reached at cliff.jamieson@dtn.com

Follow him on X, formerly known as Twitter, @Cliff Jamieson

(c) Copyright 2023 DTN, LLC. All rights reserved.

Comments

To comment, please Log In or Join our Community .