Canada Markets

Licensed Crop Deliveries as of Week 7

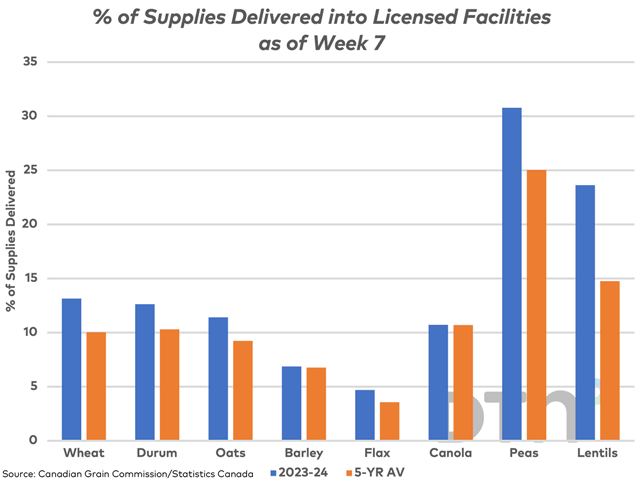

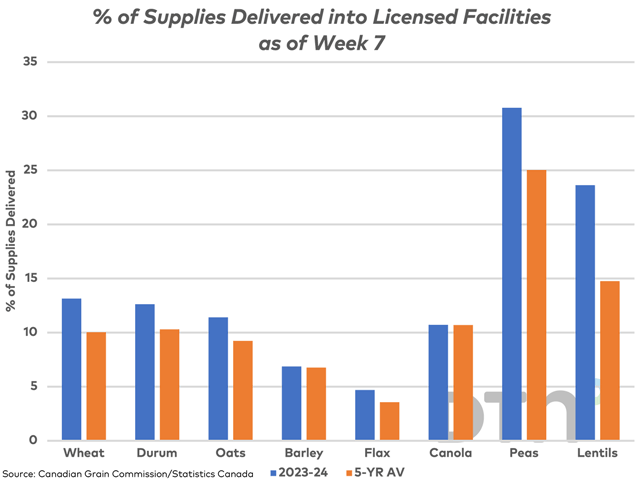

As of week 7, or the week ending Sept. 17, the Canadian Grain Commission reports total deliveries of principal field crops into licensed facilities of 8.2966 million metric tons (mmt), up 3% from the same time last year while also 3% higher than the previous five-year average.

It is interesting that wheat deliveries are up 2.7% from last year and canola deliveries are up 25%. There's a possibility that this year's early harvest and the potential for defensive selling as markets drift lower are offsetting this year's smaller crop.

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

When compared to the five-year average, wheat deliveries (excluding durum) are up 24.8% and flax deliveries are up 13%, the only two crops where deliveries into licensed facilities exceed the average pace.

The chart shows the week 7 cumulative producer deliveries as a percentage of supplies available for delivery. The calculation for the 2023-24 crop year (shown by the blue bars) compares the CGC's cumulative deliveries to the sum of Statistics Canada's July 31 farm stocks estimate and most recent model-based production estimates.

For the select crops shown, the current pace of deliveries is equal to or greater than the five-year average for all crops. In the case of canola, 10.7% of available supplies have been delivered, equal to the five-year average. This difference ranges as high as 25% for dry peas, 5.8% higher than average, and 14.6% for lentils, 8.9% higher than average. The much smaller prairie pulse crop is being moved quickly as producers jump on favorable price offers.

We look at this calculation from time to time. Out-of-ordinary results can point to errors or pending adjustments in current government estimates, while tightening supplies can signal growing challenges for buyers and the potential for movement in producer bids.

Cliff Jamieson can be reached at cliff.jamieson@dtn.com

Follow him on X, formerly known as Twitter, @Cliff Jamieson

(c) Copyright 2023 DTN, LLC. All rights reserved.

Comments

To comment, please Log In or Join our Community .