Canada Markets

Yellow Pea Prices Move Higher

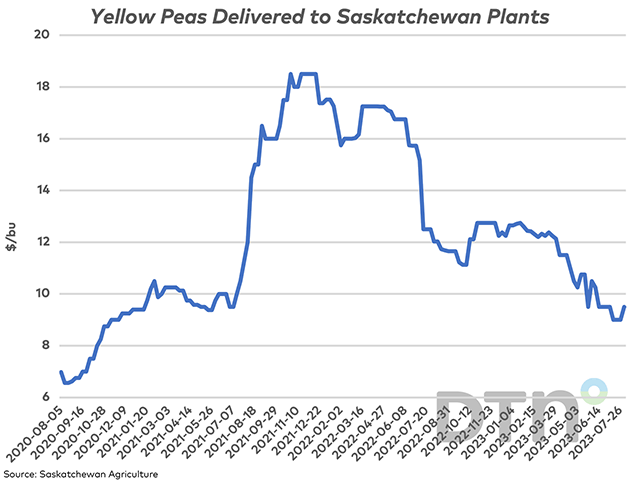

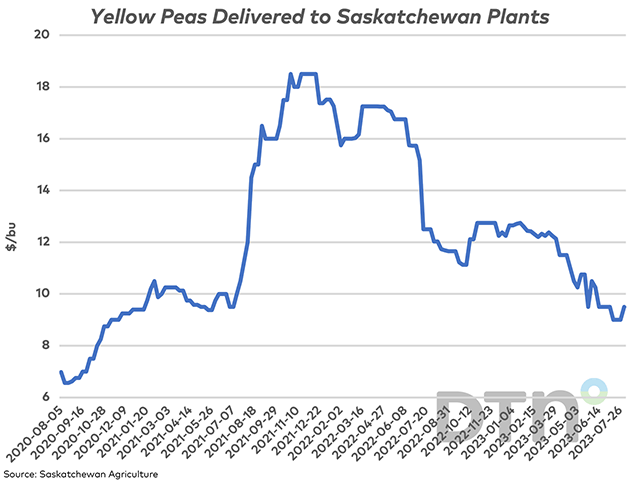

Weekly cash bids reported by Saskatchewan Agriculture show a $1/bushel (bu) increase over the past week on a price chart for yellow peas to $10/bu, while the backup data shows a $0.50/bu increase to $9.50/bu. In either case, price is seen starting to rise as combines get rolling. A Saskatoon broker is indicating prices as high as $10/bu for a No. 2 or better FOB farm. Also of interest, Statpub.com is showing Oct/Nov/Dec bids ranging from $9.42/bu to $10/bu today; no carry is seen in this market providing no incentive to hold inventory.

This can be viewed as a modest move. After reaching a high of $18.50/bu in late 2021, yellow peas hit a recent low of $9.50/bu, the lowest price reported since July 2021. Should price continue to move higher, the first retracement level or 38.2% retracement is seen at $12.63/bu, which is close to the Oct/Nov/Dec 2022 highs of $12.75/bu, which is another possible target.

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

The supply side will be watched closely this month, with some trade seeded acre estimates falling slightly below Statistics Canada's 3.04 million acres. Little exists in the way of yield estimates although Alberta Agriculture has pegged the provincial average at 34.5 bushels/acre while compared to AAFC's unofficial national estimate of 36 bpa. Statistics Canada's first official production estimates will be released Aug. 29.

On the demand side we see that Russia continues to make inroads into China, with recent reports that they recently loaded the first sea-borne vessel of peas. Food inflation remains an issue in India and G. Chandrashekhar's column for the Saskatchewan Pulse Growers notes that yellow pea imports may be a potential means of controlling domestic pulse prices. Note that the Economic Times has reported today that the government of India is negotiating directly with the Russian government on a 9 million metric ton (mmt) wheat deal, also needed to curb internal prices as the Indian government has stubbornly held on to production estimates that are 10 mmt (or more) higher than some private trade estimates.

Cliff Jamieson can be reached at cliff.jamieson@dtn.com

Follow him on X, formerly known as Twitter, @Cliff Jamieson

(c) Copyright 2023 DTN, LLC. All rights reserved.

Comments

To comment, please Log In or Join our Community .