Canada Markets

Feed Barley Prices Move Higher

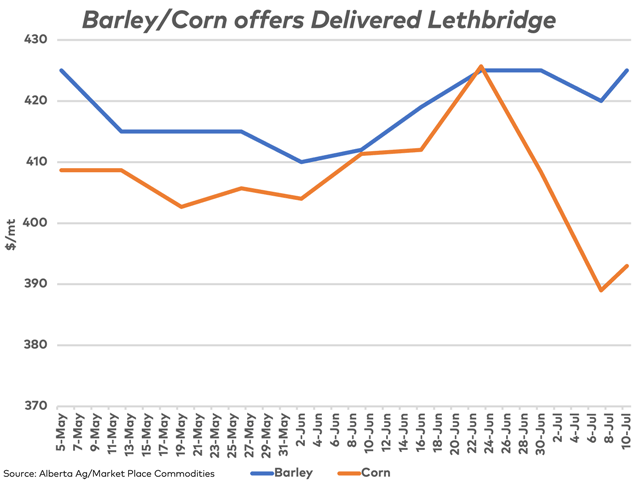

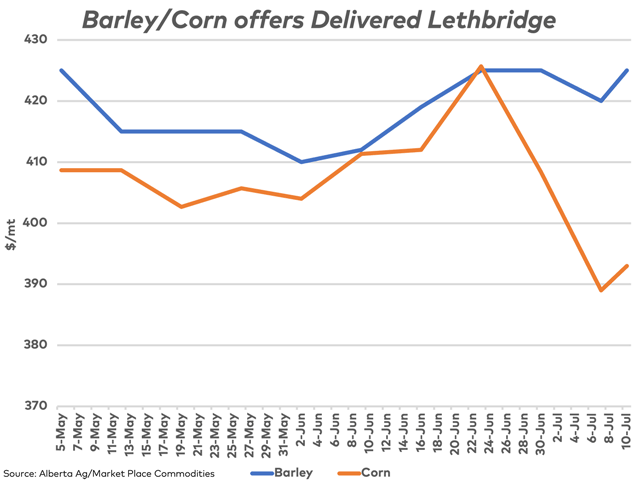

According to Alberta Agriculture, the barley price delivered into the Lethbridge, Alberta region remains strong, with the blue line representing the upper end of the weekly range reported. Today's Market Place Commodities social media price report shows a $6/metric ton increase from the end of last week to $425/mt, while reporting corn at $393/mt. This results in a $32/mt spread between cash barley and corn as shown on the attached chart, the widest spread of any week reported on the chart.

As we near the end of the respective crop years and new-crop availability, we have seen the latest AAFC forecast including a modest increase in barley stocks for 2023-24, although prairie drought is likely to threaten this forecast. At the same time, the USDA's latest June forecast includes a 55.5% increase in corn stocks year/year, although the average of pre-report estimates is pointing to a lower revision in yield of 5.7 bushels per acre off-setting a higher adjustment in seeded acres, with the result being a slightly lower revision in ending stocks when the USDA reports on July 12.

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

A sign of growing interest in new-crop corn imports is shown in weekly USDA export data. The USDA reported a first export sale to Canada of 25,400 mt for the week ending May 18, while have reported sales to Canada in each of the past five weeks, with the largest volume being the 32,800 mt sold for the week ending June 29, taking the total to 111,200 mt. This compares to 21,500 mt sold to Canada as of the same week in 2022, while the five-year average is 29,560 mt.

Canadian dollar strength against the USD has also played a role in making corn more affordable in Canadian dollar terms. Over the May through July period shown on the chart, the Canadian dollar has moved from $0.7477 CAD/USD, to a high of $0.7608 CAD/USD, while settled today at $0.7530 CAD/USD. Canada's six big banks are unanimous in expecting the Bank of Canada will hike rates on July 12, which should further support the Canadian dollar.

Cliff Jamieson can be reached at cliff.jamieson@dtn.com

Follow Cliff Jamieson on Twitter @Cliff Jamieson

(c) Copyright 2023 DTN, LLC. All rights reserved.

Comments

To comment, please Log In or Join our Community .