Canada Markets

Canola Export Basis Weakness Signals Concern

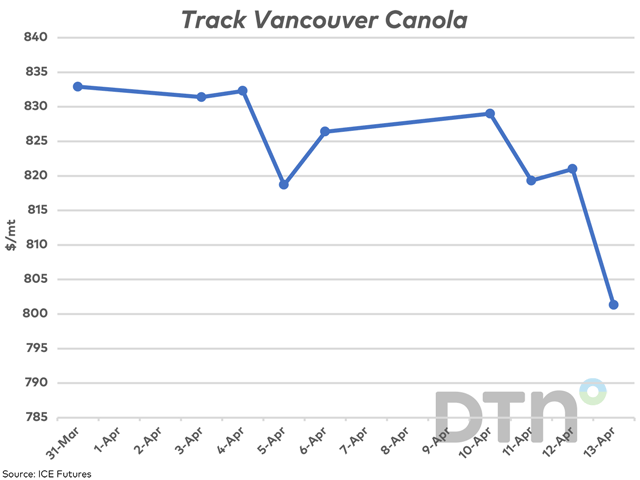

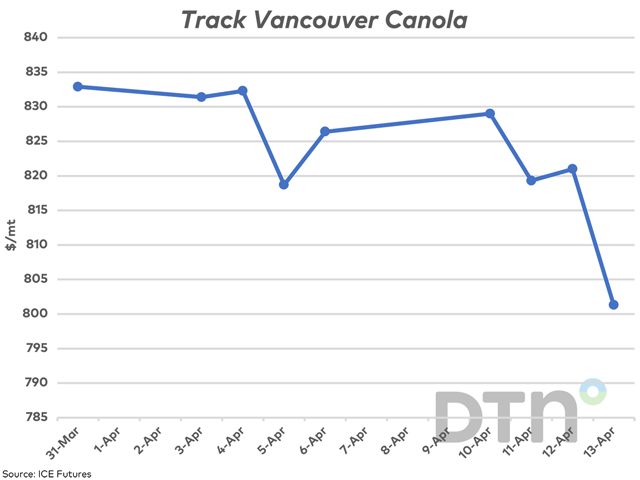

After steady track basis reported over recent months by the ICE Exchange, April trade data shows troubling signs for canola exports. Despite favorable export data to-date, DTN commentary has long pointed to concerns for canola exports, especially since the release of recent production estimates for Australia where the record crop stands to compete in both Asian and European markets.

The ICE Exchange reported the track basis at $65/metric ton over the May contract over the month of March. On April 3, this basis was reported to weaken by $10/mt to $55/mt over, while the following week, or April 11, this was shown to weaken by a further $5/mt to $50/mt over.

The most troubling move was seen on April 13, when this basis was rolled from $50/mt over the May to $60/mt over the July contract. While the spot basis is seen to improve, the May closed at a $29.30/mt inverse to the July, or above the July contract, resulting in a further weakening of $19.30/mt.

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

This weakness is seen taking place while futures have also eased back from March highs, with the July contract at the time of writing down close to $50/mt from the contract's April 3 high and roughly $95/mt from the March high.

This weakness is seen despite tight commercial stocks. The Canadian Grain Commission reported visible stocks of 1.0912 million metric tons (mmt) in store commercial storage as of April 9 or the end of week 36, which is the lowest commercial stocks seen for this week in at least 10 years.

Cumulative exports over 36 weeks of 2022-23 are reported at 6.2532 mmt, up 49.9% from last year while 5.3% below the five-year average. Over the past five years, the CGC's reported licensed exports as of week 36 accounted for 72.7% of total crop year exports on average, while this pace projects forward to crop year exports of 8.601 mmt, exactly equal to the current AAFC forecast as forecast in March.

Based on current estimates of supplies, buyers may be challenged in the final months of the crop year. During the first 36 weeks, the CGC reports 13.728 mmt of canola was delivered into licensed facilities, or 1.1% higher than the five-year average. At the same time, this represents 74.6% of total supplies available for delivery, which is calculated by adding July 31, 2022, farm stocks to 2022 production, based on current official estimates. Over the past five years, an average of 66.2% of available supplies were reported as delivered over this period.

Cliff Jamieson can be reached at cliff.jamieson@dtn.com

Follow him on Twitter @Cliff Jamieson

(c) Copyright 2023 DTN, LLC. All rights reserved.

Comments

To comment, please Log In or Join our Community .