Canada Markets

A Look at Combined Canada-U.S. Wheat Stocks

In Wednesday's DTN Early Word Grains, DTN Lead Analyst Todd Hultman pointed to larger crops in Russia, Australia and Canada in 2022 leading to wheat supplies that are currently deemed adequate for global buyers. This is seen even as Ukraine exports remain curtailed.

On Feb. 14, Graincentral.com reported official Australian data showing December exports of Australian wheat that were up 50% from the previous month to 2.664 million metric tons (mmt), with bulk wheat and durum exports shipped to 18 countries including 33% of the total volume shipped to China in bulk shipments.

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

On Wednesday, Dow Jones reported that Russia is forecast to export a record 44.2 mmt in 2022-23, with a record pace of movement expected from February through June, as estimated by Black Sea analyst SovEcon. It is conceivable that grain originating from Ukraine may have bolstered this volume.

Despite U.S. stocks that are forecast to reach their lowest volume in 15 years in 2022-23, grain futures are struggling to gain traction, with hard red spring wheat and soft red winter wheat struggling to move higher from a sideways pattern while hard red winter wheat may be struggling to sustain a move higher following losses during the past two days.

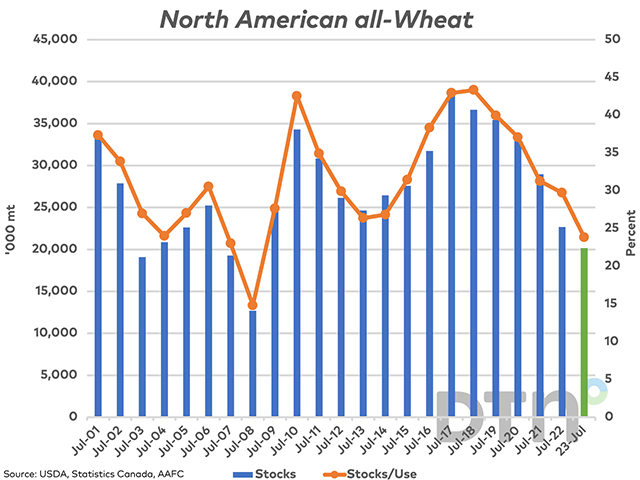

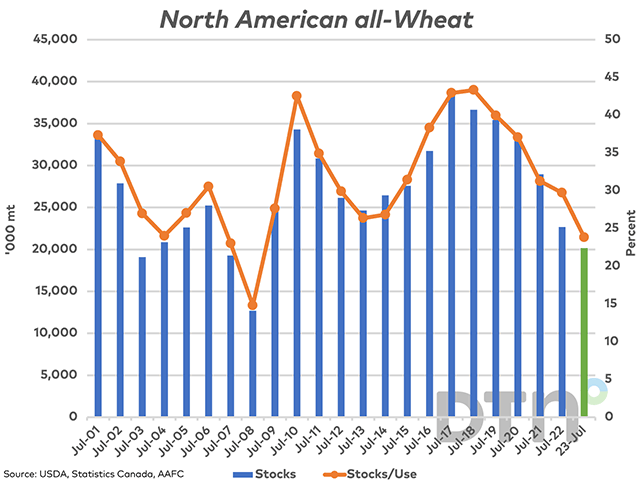

The attached chart shows the trend in the combined Canada-U.S. all-wheat stocks (wheat plus durum). The green bar shows the current estimate for 2022-23 at 20.167 mmt, falling for a sixth consecutive year and to the lowest level seen since the 2007-08 crop year, or 15 years. The most recent data from the USDA and Agriculture and Agri-Food Canada would indicate the stocks/use ratio for combined Canada-U.S. wheat will fall from 29.7% to 23.8%, also the lowest seen since 2007-08.

Cliff Jamieson can be reached at cliff.jamieson@dtn.com

Follow him on Twitter @Cliff Jamieson

(c) Copyright 2023 DTN, LLC. All rights reserved.

Comments

To comment, please Log In or Join our Community .