Canada Markets

Commercial Signals Could be Key to the Wheat Market

Wheat futures closed higher on Tuesday, with March hard red winter wheat closing higher for a sixth session, while hard red spring wheat and soft red winter wheat closed higher for the fifth time in six sessions. March SRW closed 8 3/4 cents higher or 48 3/4 cents above its January low, March HRW closed 5 cents higher or 75 1/2 cents above its January low and March HRS ended 3/4 cents higher, or 37 1/4 cents above its January low. All three markets have reached their highest trade in more than three weeks.

While there are a number of bearish and bullish factors one could reach to on any given day, what may be important is the actions of commercial traders, or those closest to the physical crop.

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

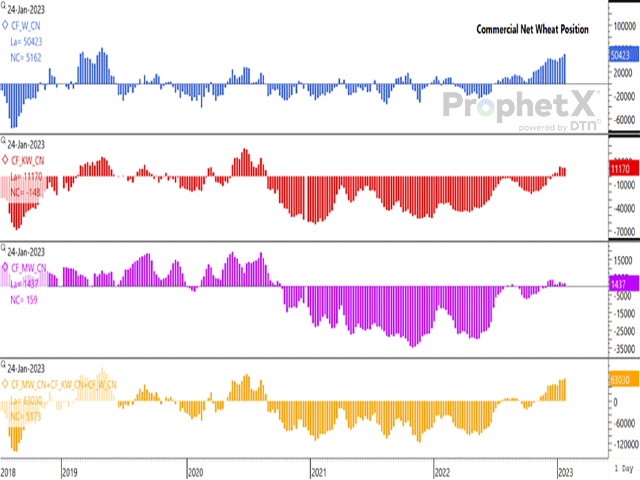

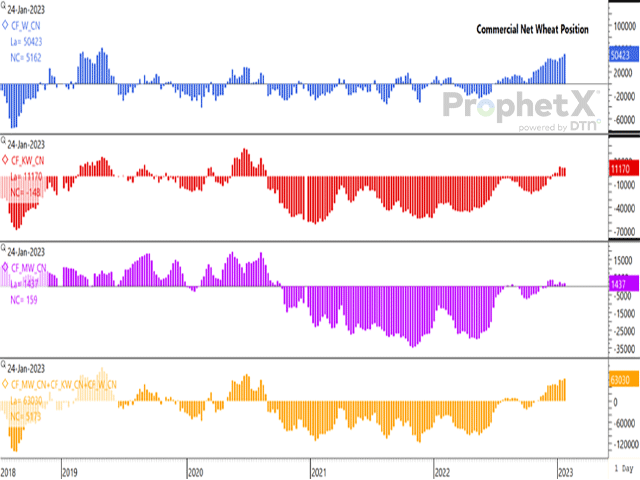

As seen on the attached chart, commercial traders held a bullish long position of 50,423 contracts of SRW as of Jan. 24 (blue bars), which has increased for a third week and to the largest held since May 2019. The red bars show the commercial net-long position in HRW at 11,170 contracts, close to the largest bullish position held since August 2020. The purple bars show the commercial net-long position of HRS at 1,437 contracts, while holding a bullish net-long position for an eighth week and for the longest period since Sept/Oct 2020.

The lower study shows the combined net-long position for the three classes, reported at 63,030 contracts, the largest reported since July 2020.

One could also point to the growing net-short position in SRW held by noncommercial traders, which is seen at 48,320 contracts as of Jan. 24, the largest seen since May 2019. While this position has grown larger for three consecutive weeks, this could prove to be viewed as a bullish factor should this group turn nervous and suddenly cover shorts.

While this may take time to play out, the question to be asked is whether it is the speculative traders or the commercial traders that have the most accurate read on this market?

Cliff Jamieson can be reached at cliff.jamieson@dtn.com

Follow him on Twitter @Cliff Jamieson

(c) Copyright 2023 DTN, LLC. All rights reserved.

Comments

To comment, please Log In or Join our Community .