Canada Markets

Soybean Oil's November Finish

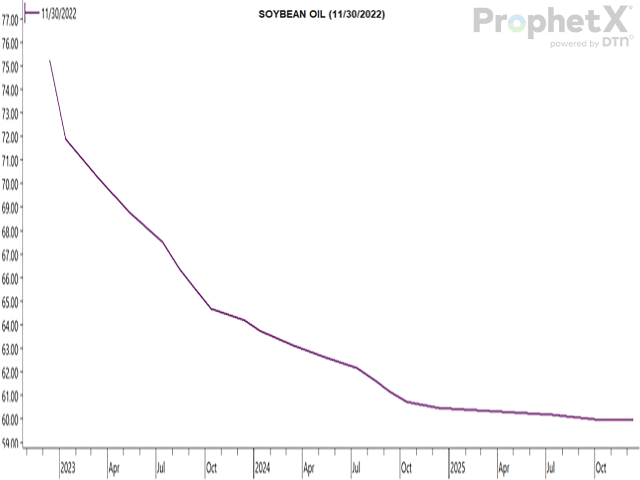

Soybean oil for January delivery posted a weak finish to end the month of November, ending down 1.1 cents to 71.88 cents USD, failing to sustain a move above the contract's 20-day moving average for the first time in three sessions.

The January/March contract spread weakened modestly to 1.61 cents (January inverted over the March contract), the weakest spread seen in over one month or since Oct. 17. While well below the 2.94-cent high reached on Oct. 26, there still remains a significant inverse that represents bullish front-end demand.

The January monthly chart shows a gain of 1.27 cents for the month of November, a second consecutive monthly gain and the fourth monthly gain in five months. Trade continues to hold above the 61.8% retracement of the move from the June high to July low, while resistance lies at the 20-day moving average at 72.74 cents and the November high of 75.94 cents.

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

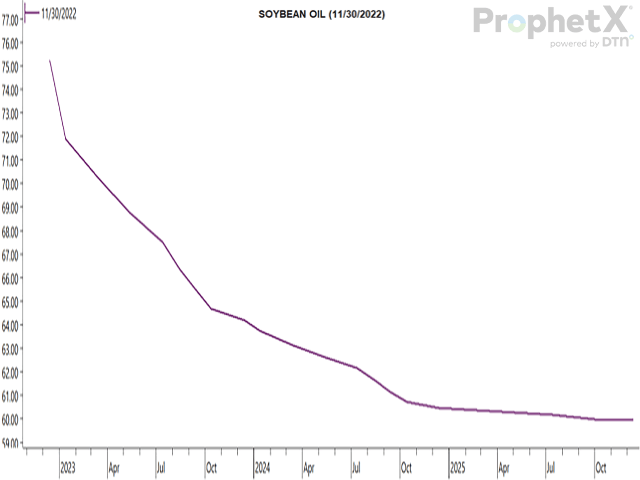

The attached forward curve attaches the November 30 close for all contracts to form a line. The downward sloping nature of this line, with each contract closing higher than the contract that follows well into 2025, signals an ongoing bullish view of this market and should remain a supportive feature for competing vegetable oils.

Late November saw downward momentum on the January chart which has increased into early December, with rumors of 2023 U.S. blending limits circulating which bears watching.

**

DTN Ag Summit

This year's Ag Summit will be held virtually on the mornings of Dec. 12-13, so you can join from the comfort of your own home. Further details can be found at http://www.dtn.com/…

Cliff Jamieson can be reached at cliff.jamieson@dtn.com

Follow him on Twitter @Cliff Jamieson

(c) Copyright 2022 DTN, LLC. All rights reserved.

Comments

To comment, please Log In or Join our Community .