Canada Markets

Oilseed Markets Send Varying Signals

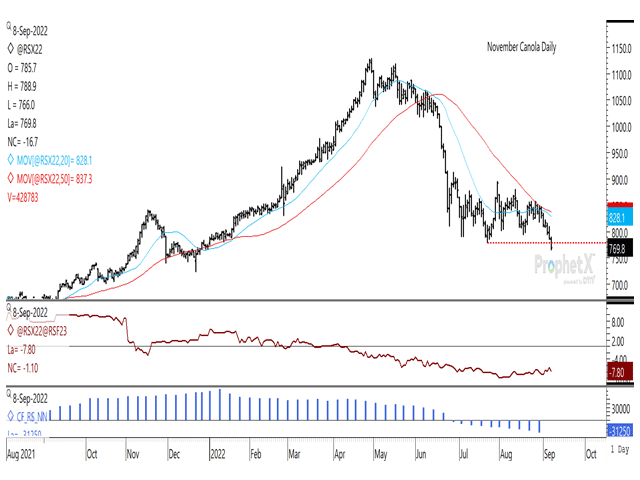

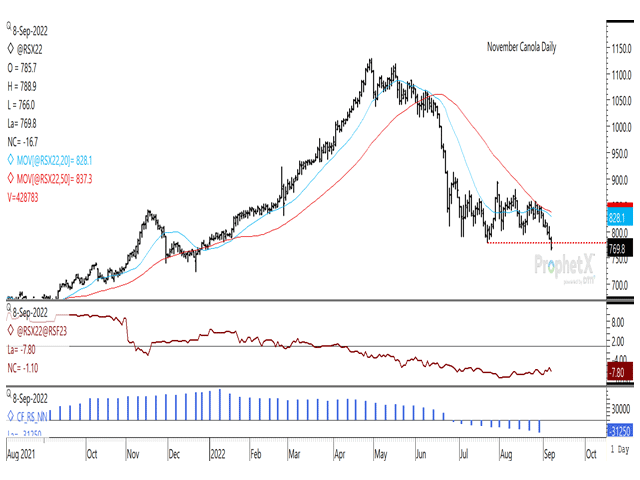

The Sept. 8 close sent a bearish signal for the canola market, with a close below $800/metric ton on Sept. 6 followed by two consecutive daily losses. The Sept. 8 move saw price breach the support at $779/mt, or the lowest level traded over more than 10 weeks. Psychological support lies at the $750/mt level, while the 61.8% retracement of the move from the contract low to contract this is calculated at $734.70/mt.

Noncommercial sellers have been behind the move. As seen in the histogram in the lower study, the noncommercial net-short position has increased in eight of the past nine weeks, with the most recent data as of Aug. 30 showing a net-short position of 31,250 contracts, or the largest bearish position seen July 2020, more than two years. The next CFTC report as of Sept. 6 will mostly likely show a continued extension of this trend.

Crude palm oil in Malaysia showed a similar movement in Sept. 8 trade, with the benchmark November contract closing 3% lower to take out an eight-week low, while reaching its weakest trade since October.

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

It wasn't all bearish news on Sept. 8, with crude oil, soybeans and soybean futures all holding above support, while closing higher for the session. Soybean oil printed a bullish outside bar this session, which could prove to be a turning point for the market.

European rapeseed for November delivery also breached support, trading as much as EUR 29.25/mt lower to EUR 580/mt, although late session buying interest pared losses, with the November contract ending down EUR 9.25/mt lower at EUR 600/mt, above support.

Next week could prove a big week in the way of reports, with the USDA to report on Sept. 12 while Statistics Canada will release updated production estimates on Sept. 14. Today's Saskatchewan Crop Report includes an estimate of canola yield averaging 34 bushels per acre (bpa), down from the 37.5 bpa average released by Statistics Canada for the province. The difference between these two estimates is roughly 950,000 mt of production.

Another interesting factor to watch is that prices tend to find a bottom in September and rally from there. Over 10 years, the November contract's final settled price was below the low reached in the Aug. 31 to Oct.3 period only once, which was seen in 2018. Over the 10 years, the final settled price for the November contract averaged $43/mt higher than the low reached over this period.

Cliff Jamieson can be reached at cliff.jamieson@dtn.com

Follow him on Twitter @Cliff Jamieson

(c) Copyright 2022 DTN, LLC. All rights reserved.

Comments

To comment, please Log In or Join our Community .