Canada Markets

Canada's Wheat Fundamentals a big deal in 2022-23

In advance of the August USDA WASDE report and a critical month for the North American spring wheat crop, we reflect briefly on the July WASDE forecast for global wheat. Global production of all-wheat is forecast to fall to 771.64 million metric tons in 2022-23, the first drop in four years and a forecast reduced by 1.8 mmt in July, while the global consumption estimate of 784.2 mmt exceeds production by 12.581 mmt.

If realized, the 2022-23 crop year would be the third consecutive year that global consumption has exceeded production, as well as the fourth year in the past five years and the largest volume where demand has exceeded production in 10 years.

As a result, global ending stocks of all-wheat is to fall to 267.52 mmt, the smallest stocks in six years. When China's stocks are netted out, global stocks total 126 mmt, with 54.597 mmt of this volume held by the eight major exporters. This would be the smallest volume held by this group of eight in 10 years, while reflecting 20.4% of total global stocks, the smallest percentage seen in decades although by a slim margin.

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

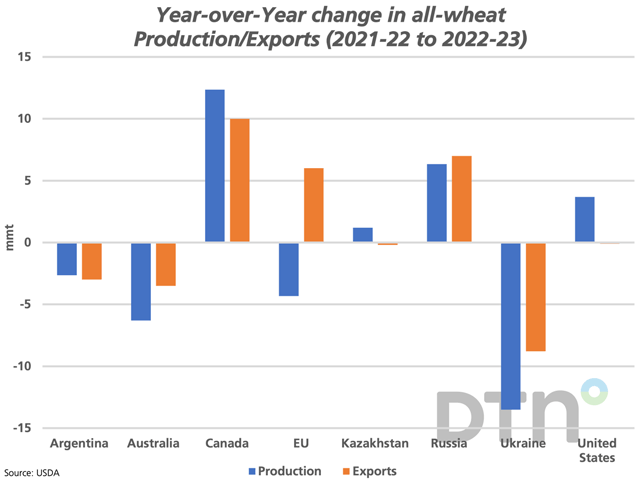

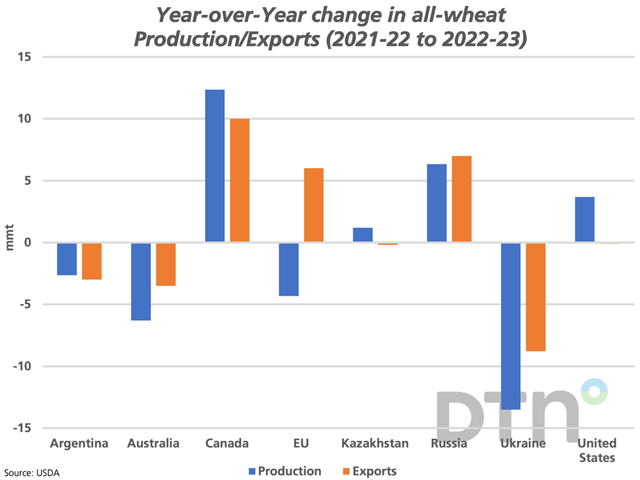

The attached chart shows the year-over-year change in forecast for both production and exports for the world's eight largest wheat exporters, based on the USDA's July WASDE forecast for 2021-22 and 2022-23. The most recent forecast shows how Canada and Russia may be key to overcoming the losses forecast for Ukraine, which can be viewed as highly tentative based on the ability to harvest and export the crop.

While global demand is forecast to fall in 2022-23, five of the eight major exporters are forecast to export a smaller volume than achieved in 2021-22. The most recent forecast shows the E.U. forecast to increase exports by 6 mmt, Russia by 7 mmt, while Canada is forecast to boost exports by 10 mmt.

Of course, all estimates are on the table and may face revisions on August 12. Spring wheat crops on both sides of the Canada/U.S. border may require a few extra weeks to reach maturity and will be watched closely by a wide audience.

There should be no surprise that a United Kingdom company has teamed up with Canadian analysts for a prairie crop tour this week; there is a great deal riding on this crop and its development may matter more than ever to the global balance sheet.

Cliff Jamieson can be reached at cliff.jamieson@dtn.com

Follow Cliff Jamieson on Twitter @Cliff Jamieson

(c) Copyright 2022 DTN, LLC. All rights reserved.

Comments

To comment, please Log In or Join our Community .