Ag Weather Forum

Drier Northern Europe Trend Brings Production Loss Potential

The term "blocking high pressure" has firmly cemented itself into weather commentary for the 2023 summer season. Robust high pressure in the upper atmosphere over north-central Canada was cited as a primary contributing factor in the outbreak of wildfires across eastern Canada which wafted into the central and eastern U.S.

The blocking high also favored sustained moisture inflow to bring heavy rain and flooding, along with drought relief, into the interior western and southwestern U.S.

But blocking high pressure is not unique to the skies over North America. For this feature to even occur, there must be another such feature elsewhere. And that has indeed been the case over northern Europe, as noted in the USDA weekly weather and crop bulletin from June 13, 2023.

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

"A blocking area of high pressure anchored over northern Europe maintained the recent pattern of northern dryness and southern rain," stated the bulletin. "The large, sprawling high centered over Scandinavia sustained sunny skies and above-normal temperatures (2-5 degrees Celsius above normal) from England and northern France into Poland and the Baltic States. Overall, the dry and warm weather was beneficial for reproductive (northeast) to filling (elsewhere) winter grains and oilseeds after a wet first two months of spring, though soil moisture has become limited for vegetative spring grains and summer crops."

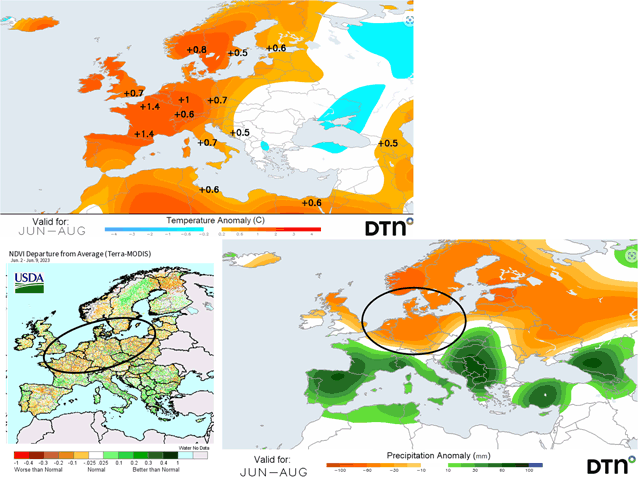

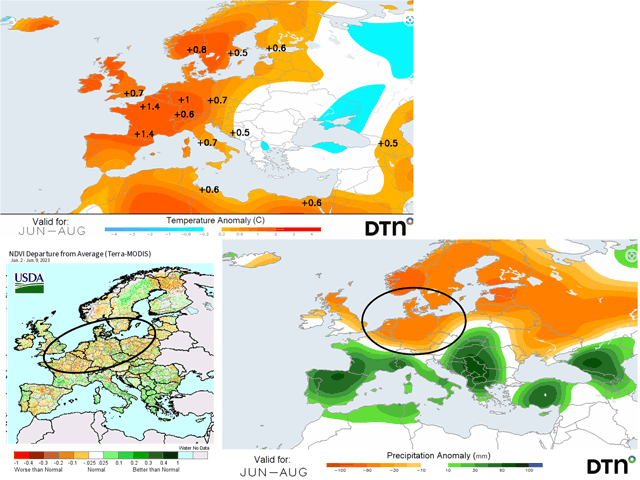

This blocking high has been a notable dry weather maker. Its presence has led to vegetative health index values which are below normal across much of northern and central France, most of Germany, and into northern Poland along with the Scandinavian countries. This sector produces a large portion of Europe's total grain crops, notably wheat.

Up to now, conditions have been favorable for Europe's wheat crop despite harsh dryness in Spain and Portugal during the first part of 2023. USDA's June World Agricultural Supply and Demand (WASDE) report projects that the European Union in total will produce 140.5 million metric tons (mmt) of wheat in 2023-24, up 5% from 2022-23. The higher total in Europe is part of the USDA 2023-24 world wheat production estimate (less China) of 660 mmt, up 2.5% from 2022-23.

But that stubborn blocking high pressure influence may be getting in the way of this projection -- or at least hindering its full realization. The NOAA/National Centers for Environmental Information (NCEI) report for Europe's spring season (March-April-May) notes, "Over Europe, dryness and negative rainfall anomalies continued across its northern mid-section, France, Germany and to the east, especially across most of Russia, with wildfires scattered from the Urals to Siberia, with the loss of 20 lives in one event." In all, the Northern Hemisphere spring 2023 temperature was the third warmest on record at more than 2.3 degrees Fahrenheit above average.

And the drier trend is starting to show up in crop ratings as well. The Australia-based Lachstock Grain Central noted on June 13 that "FranceAgriMer reports as at 5 Jun, the 2023-24 common wheat crop was rated 88pc good/excellent, down from 91pc the previous week (66pc previous year), durum 82pc (86pc previous week, 62pc previous year), winter barley 87pc (88pc, 64pc), spring barley 89pc (93pc, 53pc) and maize 88pc (92pc, 88pc)." So, while crops are in much better shape than a year ago, there are questions about how the final stages before harvest will be for filling and ripening.

The summer months of June, July and August feature warm and dry conditions in the northern half of Europe. DTN forecasts feature widespread above-normal temperatures, with some parts of western and northern Europe averaging 1.4 degrees C (2.5 degrees Fahrenheit) above normal, along with rainfall deficits of 50% less than normal in northern Europe. Even after the blocking high pressure moderates, its dryness influence in the high-production areas may linger throughout the summer season.

Bryce Anderson can be reached at Bryce.anderson@dtn.com

(c) Copyright 2023 DTN, LLC. All rights reserved.

Comments

To comment, please Log In or Join our Community .