Ag Policy Blog

USDA releases Study on Ag and Carbon Markets

Carbon credits can help farmers generate income and help companies lower their emissions, but USDA must find ways to help farmers overcome some of the barriers that exist.

USDA on Monday sent a report to Congress examining the role of agriculture and forestry in U.S. carbon markets.

The 83-page report offers a primer on carbon registries and the various markets developing in this area. The report takes a look at compliance markets such as California as well as voluntary carbon markets. The report was required as part of the Growing Climate Solutions Act, which was added to a government funding bill in the last Congress.

The report found that carbon credits can be a tool to reduce greenhouse gas emissions and generate revenue for farmers that adopt practices that reduce emissions or sequester carbon. The same carbon credits also can help companies achieve emission goals.

"However, barriers exist that have hindered the participation of agriculture in these markets."

Looking at the landscape for carbon credits, USDA found there were 18 protocols that have successfully generated carbon credits in the U.S., but there are more than 41 active protocols that could include agriculture, forestry or land use.

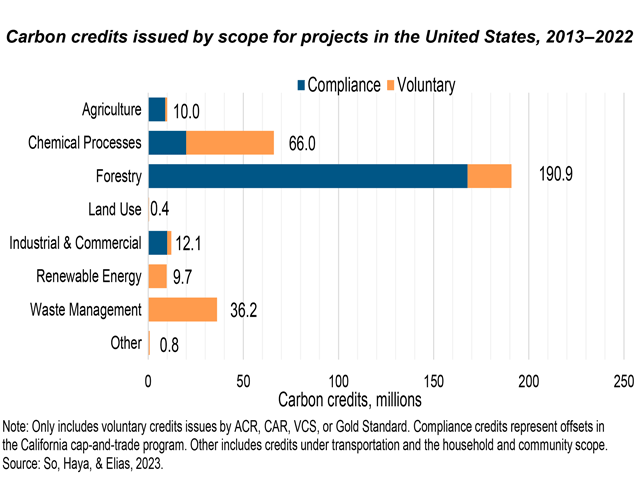

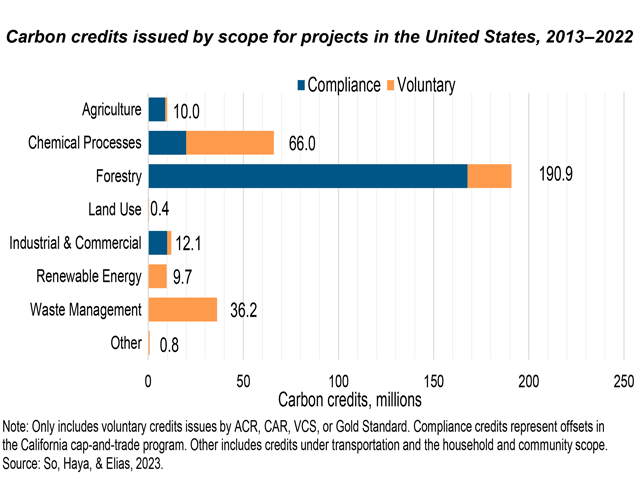

Over the past decade, different compliance markets have generated more than 176.7 million metric tons of compliance carbon credits while voluntary markets have generated 24.5 million metric tons of credits. The compliance market, however, has dropped off dramatically since 2020.

The biggest gains in carbon credits, by far, have come in the forestry sector.

FARMERS AWARE, BUT NOT PARTICIPATING

The report points to a study by Trust in Foods showing 93% of livestock and crop managers are aware of carbon markets, but only about 3% right now participate in them.

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

While forestry has the dominant number of carbon credits, only about 1% of landowners have participated in them.

Producers see barriers as "limited return on investment as a result of high transaction costs" as a main issue as the credit prices are not enough to cover the cuts of "quantification, verification and reporting." There is also limited access to early adopters and challenges over strict permanence requirements for those credits. There's also simple confusion over options and a lack of demand for carbon credits in general.

CREDIT PROTOCOLS SMALER THAN EXPECTED

Of 18 carbon credit programs active in agriculture, only four are active in the role of soil carbon, and of those only two have issued carbon credits, USDA stated. Two protocols have issued credits for livestock manure digesters and two have issued credits for nutrient management. In comparison, forestry has 16 protocols and seven of those have issued credits.

USDA cites a study pointing that if the five largest crops in the country by acreage adopted cover crops, that would amount to roughly 217 million acres and sequester about 103 million metric tons of carbon dioxide equivalent every year.

There have been at least four programs that are set up to help reduce direct or indirect emissions from nitrogen fertilizer applications, but they have only generated about 75 metric tons of carbon dioxide equivalent emission reductions. Those projects mostly died out around 2019 and USDA states, "additional projects solely focused on nitrogen management are unlikely."

MANURE AND METHANE

One of the bigger areas for carbon credits is in the capture or removal of methane from manure management and methane digester projects. They have generated roughly 9.8 million metric tons of credits over the past decade. More than 90% of those credits have been generated through California's cap-and-trade program. Methane digester credits are popular in Idaho, Wisconsin and California, but livestock producers in at least 20 states have received credits.

MOVING AHEAD

Right now, USDA has $3.1 billion in climate-smart pilot commodity projects underway nationally to help encourage farmers in different commodities to take up practices that reduce emissions or sequester carbon in the soil.

The Inflation Reduction Act also provided another $19.5 billion for USDA's traditional conservation programs to help provide dollars to producers to a range of practices that will lower emissions and sequester carbon.

Separately, USDA is spending $300 million to increase the monitoring, measurement, verification and reporting of greenhouse emissions in agriculture.

USDA will also take the study to further drill into potential standards for companies that market carbon credits to farmers and livestock producers.

The full study can be found at https://www.usda.gov/…

Chris Clayton can be reached at Chris.Clayton@dtn.com

Follow him on X, formerly known as Twitter, @ChrisClaytonDTN

(c) Copyright 2023 DTN, LLC. All rights reserved.

Comments

To comment, please Log In or Join our Community .