USDA's May WASDE old crop and first new crop stocks-to-use ratios for U.S. corn and soybeans.

USDA's May WASDE old crop and first new crop stocks-to-use ratios for U.S. corn and soybeans.

Old crop and new crop wheat export sales vs. each of those figures as a percent of the May USDA WASDE export projection as of the third week in May.

End of April Palmer Drought Severity Index readings (PDSI) for both states vs. the mid-May percent of each date in D1-D4 drought as reported by the weekly U.S. Drought Monitor site.

First oat crop rating of each year from 1996 to 2024 along with the rating seen the last week of July when the crop is well advanced and close to being harvested vs. the percent that the final oat yield of each season deviated from the 25-year trend

USDA's old and new crop U.S. corn stocks-to-use ratios in the May WASDE report vs. the change in both the old and new crop U.S. corn stocks-to-use ratios from the May to November WASDE reports.

Change in the November soybean/December corn ratio from April 1 to May 6 since 2005 vs. the change in U.S. corn and soybean planted area in 1000 acres from the March 31 Prospective Plantings to the June 30 Acreage Report

U.S. corn export sales and shipments in million bushels as of the third week of April on the left-hand axis while reported on the right-hand axis are those figures as a percent of the USDA's April WASDE estimates.

Five-, ten- and twenty-year average weekly CME soybean crush margins in dollars per bushel vs. the weekly 2024 values

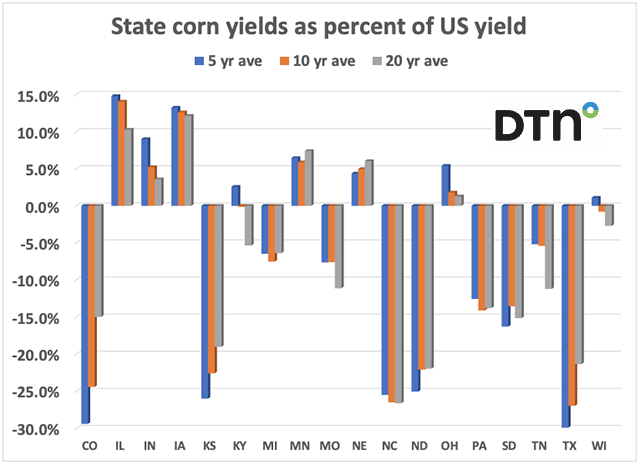

State yields of the top 18 soybean producing states as a percent of the U.S. yield looking at the twenty, ten and then five-year averages

There really are only six states that have yields consistently above the U.S. yield: Illinois, Indiana, Iowa, Minnesota, Nebraska and Ohio.

October 2023-March 2024 total precipitation as a percent of the average 1896-2024 October-March figure for the top 21 corn and soybean producing states vs. end of March Palmer Drought Severity Index (PDSI)

Percent of total corn and soybean stocks held on-farm vs. the total 3/1 corn and soybeans stocks as a percent of the prior year

This week, in its first national winter wheat condition report of the spring, USDA showed 56% of the crop in good-to-excellent condition, which is double the 30% of a year ago.

End of March December corn price along with the 2007-2024 end of March average Dec price of $4.76 vs. the end of March November soybean price along with the 2007-2024 end of March average Nov price of $11.15

Percent of U.S. corn planted by April 30 and May 25 vs. acreage change for corn and soybeans from March intentions to the final figure

average percent change in U.S. soybean planted area from the March intentions to June acreage report, the June acreage to the final production figure, and also the March intentions to the final number for the top 18 producing states and the U.S.

Percent change in U.S. soybean planted area from the March intentions to June acreage report, the June acreage to the final production figure and the March intentions to the final number.

Change in the November soybean/December corn ratio from Jan 1 to Feb 1, Feb 1 to Mar 1 and Mar 1 to Apr 1 vs. the SX/CZ ratio as of Mar 1.

Change in the November soybean/December corn ratio from Jan 1 to Feb 1, Feb 1 to Mar 1 and Mar 1 to Apr 1 vs. the SX/CZ ratio as of Mar 1.

10- and 20-year average percent changes in planted soybean acreage for the top 18 growing states and the U.S. from the March intentions to the June acreage reports and then the June Acreage figures until the final production report numbers.

DIM[2x3] LBL[blogs-fundamentally-speaking-list] SEL[[data-native-ad-target=articleList]] IDX[2] TMPL[news] T[]

DIM[2x3] LBL[blogs-fundamentally-speaking-list-2] SEL[[data-native-ad-target=articleList]] IDX[5] TMPL[news] T[]