Sort & Cull

Even Bullish Markets Have Bad Days

I scrolled through X, formerly known as Twitter, last week and couldn't help but notice the negative comments regarding the cattle market and saw numerous comments along the lines of, "This doesn't feel like a bullish market to me," popping up left and right. What sparked negative remarks was the October live cattle contract had recently endured five-consecutive days of lower price closes, and cash cattle prices were trading steady to $1 lower.

But that's where I have to draw a line and remind myself -- and others -- that even bull markets have lower-price days, and sometimes even lower weeks.

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

I'll be the first to admit that today's cattle complex seems far more influenced by outside factors than it was just even five short years ago, but we as cattlemen, analysts and market participants fuel the anxious, jittery nature of the market when our focus is only on short-term signals.

Sure, the market recently endured five consecutive days of lower closes, but on the morning of Aug. 21 the market gapped higher. Point being, if we allow ourselves to have an emotional reaction to every day's close, the market's long-term fundamentals don't stand a chance at ever coming to fruition.

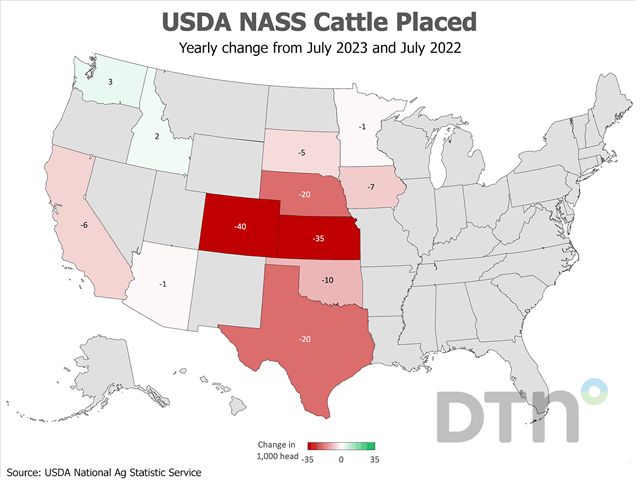

And Aug. 18's bullish Cattle on Feed report could be the recharge that the market needs. (See https://www.dtnpf.com/…) With both on-feed and placement figures lighter than a year ago, no one can deny the fact that showlists are going to be thin moving forward; so long as beef demand remains strong, cash cattle prices should be able to maintain their elevated position.

I'm especially interested to see how feeder cattle and replacement females sell this week on Superior's Big Horn Classic video auction. The auction has 221,510 head consigned and given that the long-term outlook for the market remains favorable, prices could be even higher than what they have been, thanks to the added encouragement of the COF report and the decline in corn prices.

ShayLe Stewart can be reached shayle.stewart@dtn.com

(c) Copyright 2023 DTN, LLC. All rights reserved.

Comments

To comment, please Log In or Join our Community .