Technically Speaking

Dry Weather Concern Interrupts Corn's Downtrend

CORN:

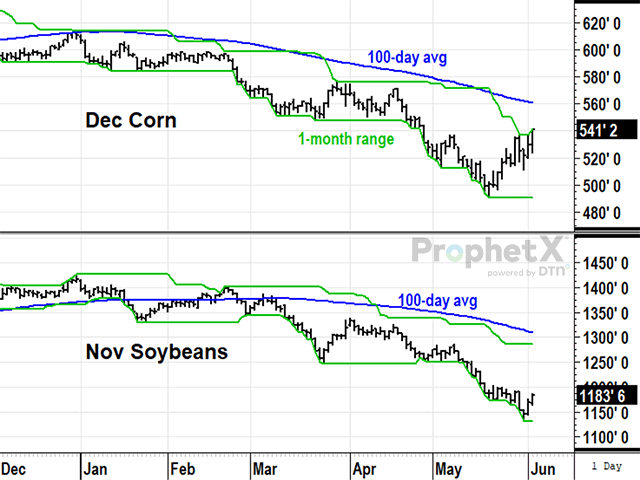

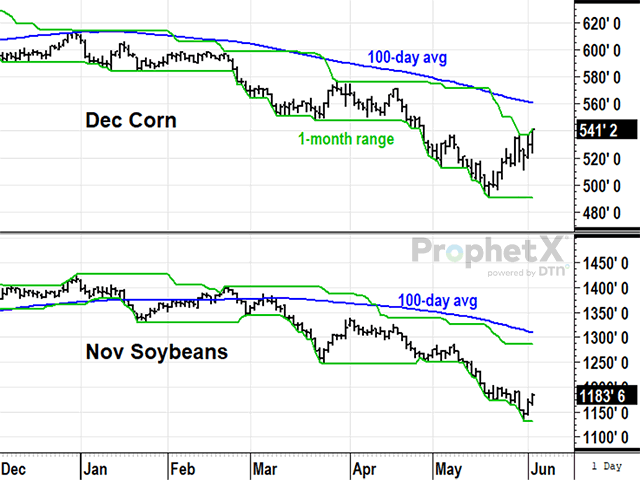

December corn closed up 6 3/4 cents at $5.41 1/4 in the week ended Friday, June 2. It was not a big weekly gain, but it was technically significant as it added to the previous week's 34 3/4-cent gain and ended at its highest level in over a month, something December corn has not done since October 2022. Prices had been trending lower since December as the market began anticipating the possibility of a larger harvest in the coming fall and the higher ending stocks that go with it. Friday's close is still below the 100-day average at $5.61, but the development of dry weather in June along with Friday's new one-month high is a potentially bullish recipe for a summer rally, which no one knows how long it will last. Technically, support for December corn held near $5.00 and the weekly stochastic has turned up, signaling an interruption in the downtrend. Summers are known for increased volatility and there may be higher prices ahead, but this is also a rally that could come and go quickly. Producers who missed hedge opportunities in December corn the first time around may want to consider placing orders above the market. Until more is known about this year's crop, this does not yet look like a lasting change in trend.

SOYBEANS:

November soybeans ended down 5 3/4 cents at $11.83 3/4 in the week ended Friday, June 2, but were able to gain 37 1/4 cents the final two days of the week on the same concerns about dry weather described above for corn. November soybean prices have dropped over $1.60 a bushel since the end of February and prices are near levels where crop insurance will start to provide protection, but there is no sign yet a significant change in trend is taking place. Dry conditions could get drier in June, but soybeans also have a reputation for their ability to endure early dryness and still do well, as long as timely rains arrive in August. As mentioned for corn, a summer rally is always possible for soybeans, but technically speaking, there is no sign of a significant change in the downtrend at this time. On a related note, limited supplies of old-crop soybeans are a more bullish situation than new-crop soybeans. July soybeans posted a bullish weekly reversal Friday and have a good argument for prices holding above $13.00.

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

**

Comments above are for educational purposes only and are not meant as specific trade recommendations. The buying and selling of grain or grain futures or options involve substantial risk and are not suitable for everyone.

**

If you missed DTN's Ag Summit Series event, "Crop Updates From the Field" or were too busy to register, here is a second chance. Register now and you'll be able to access recordings of the event in which we visited with farmers from across the country, talked about the latest dicamba and pesticide news, and discussed DTN's latest weather and market outlooks. This extended registration period will close on June 5 at 5 p.m.

Here's the link to register:

There may be a time delay between when you register and when you can access the recordings.

Todd Hultman can be reached at Todd.Hultman@dtn.com

(c) Copyright 2023 DTN, LLC. All rights reserved.

Comments

To comment, please Log In or Join our Community .