Technically Speaking

After A Bearish Run, Energy Prices Are Firming

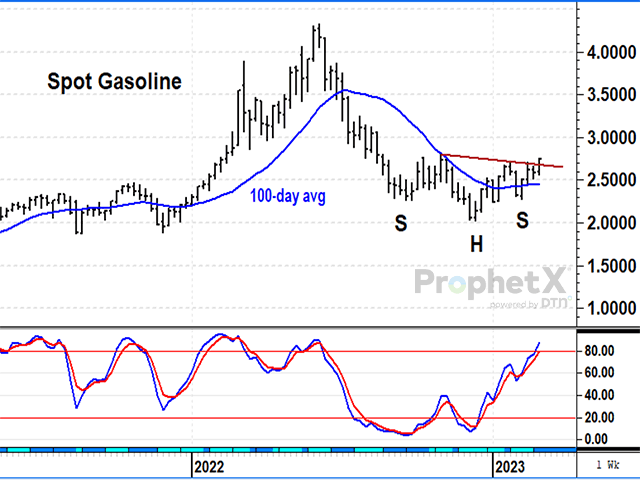

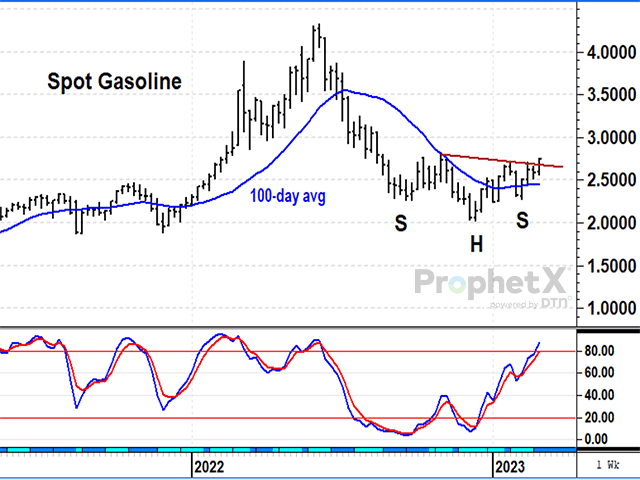

RBOB GASOLINE:

April gasoline futures closed up 16.9 cents in the week ended March 3, settling at $2.7504 Friday. Not only was it the highest close in a month, but on a weekly chart it also completed a bullish breakout of an inverse head-and-shoulders pattern, a sign of higher prices ahead. Energy prices in general peaked in June last summer and have been falling since, pressured by concerns about a slowing world economy. Gasoline prices were the first to show a bullish change in trend, while other energy prices are showing signs of support. In the Energy Department's (DOE) latest inventory report, gasoline supplies totaled 239.2 million barrels, the lowest in nine years as tight supplies are likely to be a concern again this summer.

ULTRA-LOW SULFUR DIESEL: April diesel futures closed up 14.6 cents at $2.9131 in the week ended March 3, a second week higher after failing to follow-through on new lows, below $2.76. Like most energy prices, diesel peaked in June 2022 and has chopped lower for the past eight months with frequent concerns about economic activity. Last week's higher weekly close is a timely sign of support and is close to turning the weekly stochastic higher, the possible start of a bullish change in trend. Supplies of ultra-low sulfur distillates were last reported at 112.3 million barrels, the second lowest total in eight years. To confirm an uptrend, April diesel would need to sustain trading above $3.00 a gallon, but it does look like the eight-month correction is coming to an end.

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

NATURAL GASS:

April natural gas closed up 46.1 cents at $3.009 per million Btus, the highest close in over a month. Of all the energies, natural gas production has done the best job of rebounding since COVID and this winter's drop in prices has been the biggest bearish surprise of the season. U.S. natural gas in storage is up 27% from a year ago, an impressive feat after helping build Europe's supplies last fall. Technically speaking, after spot prices fell to a two-year low of $2.057 in February, a reversal was posted on the weekly chart, an early sign that selling may have finally run its course. This week's close above $3.00 turned the weekly stochastic higher, but prices are still a long way from proving any change in the overall trend. At best, prices are likely to find a new, lower trading range with support near $2.00.

**

Comments above are for educational purposes only and are not meant as specific trade recommendations. The buying and selling of grain or grain futures or options involve substantial risk and are not suitable for everyone.

Todd Hultman can be reached at Todd.Hultman@dtn.com

Follow him on Twitter @ToddHultman1

(c) Copyright 2023 DTN, LLC. All rights reserved.

Comments

To comment, please Log In or Join our Community .