Technically Speaking

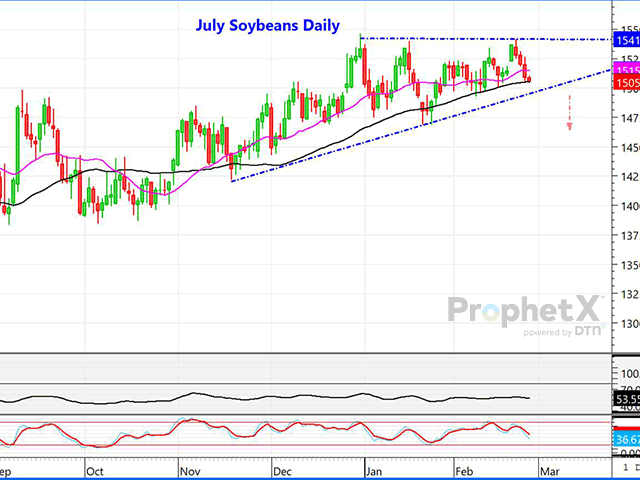

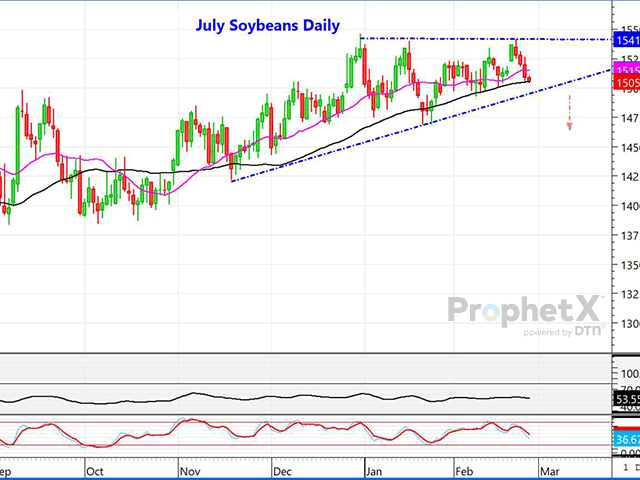

Are Old-Crop Soybean Futures on the Edge of a Possible Trend Change?

It has been well documented that the long drought in Argentina has decimated part of that soybean crop, but Brazil is facing a much different outlook. At this point, with over 30% of the Brazilian soy crop already harvested, it would appear there is little chance the crop will be anything less than a record-by-far crop. So far, roughly 46 million metric tons (mmt) (1.69 bb) of new-crop Brazilian soybeans have been harvested, and Brazil offers are far below those of the U.S. The window for additional U.S. soybeans sales should be closed, barring any transportation or other problems in Brazil.

The potential loss of roughly 10 mmt of Argentine production should be more than offset by the predicted 153 mmt crop in Brazil, and the near record crop in Paraguay. The CFTC's Commitment of Traders report played a bit of catch up on Friday, and as of Jan. 31, funds were still long an estimated 220,000 contracts of soybeans and 141,000 contracts of soymeal -- near a record. Not only are Brazilian soybeans plenty cheap compared to U.S. offers, but so too is Brazil soymeal, which as of last Friday figured to be $45 metric ton (mt) cheaper on a FOB basis. U.S. soybeans and soymeal are overpriced by any measure, and I would expect that a breach of the $14.95 to $15.00 level on July beans will lead to some serious fund liquidation. A note of caution is that U.S. ending stocks remain extremely tight, but higher yield and production are predicted to add to next year's ending stocks. Of course, any weather or transportation issues in Brazil could change the outlook. The jury is still out.

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

Chicago July wheat has been in a freefall in the past nine days, where it has plunged 80 cents per bushel in that time. However, this is a market that is getting very oversold, and funds, as of Jan. 31, were short close to 64,000 contracts, and some analysts feel that short could be closer to 90,000 contracts as of the end of last week. With a still-bullish stocks number in the U.S., that is a dangerous position for funds to be carrying in light of commercial traders being long wheat in both the KC and Chicago markets. Cheap Black Sea wheat and recent beneficial moisture have pummeled this market, but it is getting overdone. Look for a bounce soon.

MAY CORN FUTURES:Last week's convincing break under a six-weeks-long sideways pattern, has the May corn chart looking more bearish to begin the new week. Yes, there are still issues in Argentina, with another 10 days of heat and dryness on tap, and with the good-to-excellent portion of the corn crop rated just 9%. However, much of the bad Argentine news may have already been incorporated in last week's lofty prices prior to the recent setback. According to the CFTC, as of Jan. 31 (still two weeks of delayed data) noncommercials still held a lofty position approaching 300,000 contracts. That, along with USDA's projected rise in ending stocks of over 600 million bushels (mb) versus last year, has the potential to weigh on the corn market even more. May corn will need to stay above the $6.37-$6.39 area -- about a dime below -- or risk additional fund liquidation.

**

Comments above are for educational purposes only and are not meant as specific trade recommendations. The buying and selling of grain or grain futures or options involve substantial risk and are not suitable for everyone.

Dana Mantini can be reached at Dana.Mantini@DTN.com

(c) Copyright 2023 DTN, LLC. All rights reserved.

Comments

To comment, please Log In or Join our Community .