Technically Speaking

Monthly Analysis: Energy Markets

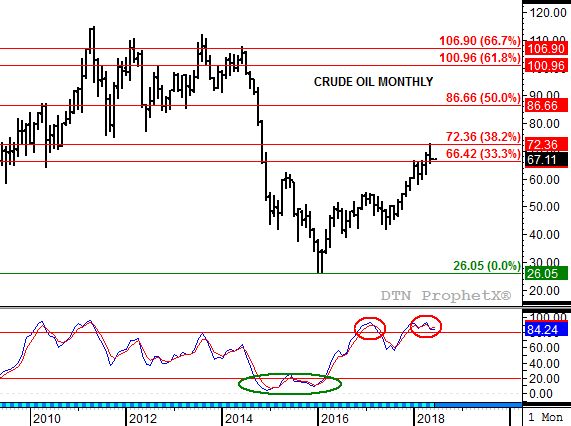

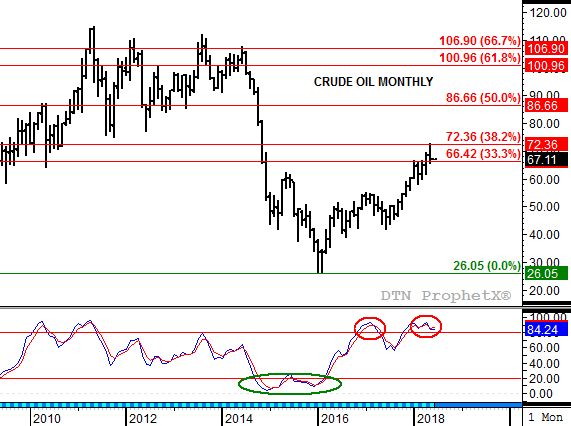

Crude Oil: The spot-month contract closed at $65.87, down $1.36 on the monthly chart. The market looks to be rolling over into a major (long-term) downtrend. The spot-month contract posted a high of $72.83 in May before closing lower for the month. This high was a test of resistance at $72.36, a price that marks the 38.2% retracement level of the previous downtrend from $147.27 (July 2008) through the low of $26.05 (February 2016). Monthly stochastics established another bearish crossover above the overbought level of 80%.

Distillates: The spot-month contract closed at $2.1914, up 2.40cts on the monthly chart. The market resumed its major (long-term) uptrend as the spot-month contract posted a new high of $2.3069 in May. However, monthly stochastics are approaching 90%, putting the market in position for a bearish turn.

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

Gasoline: The spot-month contract closed at $2.1603, up 3.11 cents on the monthly chart. The major (long-term) trend of the futures market remains up as the spot-month contract continues to test resistance at $2.1882. This price marks the 50% retracement level of the previous downtrend from $3.4789 through the low of $0.8975. Monthly stochastics remain near, but not above, the overbought level of 80%.

Ethanol: The spot-month contract closed at $1.462, up 1.7cts on the monthly chart. The major (long-term) trend is sideways with support at a series of lows near $1.292 and resistance at $1.712. A bearish factor remains the spike below support to $1.251 during December 2017.

Natural Gas: The spot-month contract closed at $2.951, up 18.8cts on the monthly chart. The major (long-term) trend looks to have turned up as the spot-month contract posted a new 4-month high of $2.988 in May. However, some of this was due to the carry/contango in the June-to-July futures spread as the June contract expired. Initial resistance remain at $3.084 with support at $2.521.

Propane (Conway cash price): Conway propane closed at $0.7525, down 3.75cts on its monthly chart. The market remains in a major (long-term) downtrend with the previous rally Wave B (second wave) of a 3-wave pattern. After testing resistance at $0.8291 the past two months, cash propane looks to be in position to move lower again. The downside target is below the Wave A low of $0.5850 (March 2018).

To track my thoughts on the markets throughout the day, follow me on Twitter: www.twitter.com\DarinNewsom

Comments

To comment, please Log In or Join our Community .