Technically Speaking

Weekly Analysis: Livestock Markets

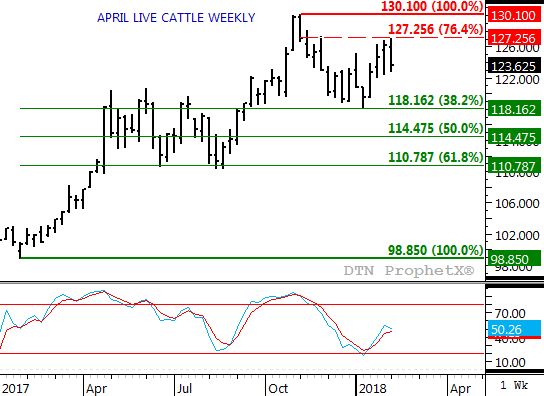

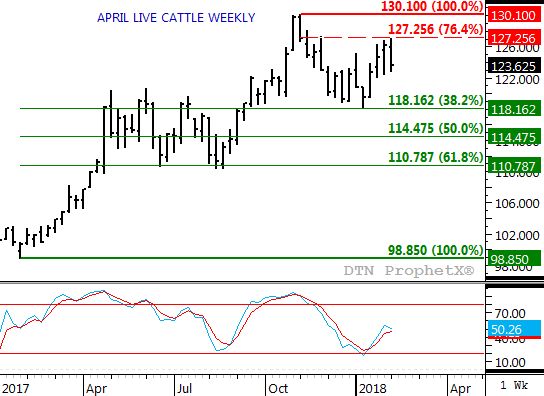

Live Cattle: The April contract closed $2.50 lower at $123.625. April live cattle remain in a 3-wave downtrend, with the recent rally (Wave B, second wave) testing resistance near $127.25. This price marks the 76.4% retracement level of Wave A from $130.10 through the low of $118.05. The latter was itself a test of initial support near $118.15, the 38.2% retracement level of the uptrend from the contract low of $98.85 through the $130.10 contract high. Given the neutral status of the April-to-June futures spread (fundamentals) the April contract could see a 50% retracement back to $114.475.

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

Feeder Cattle: The March contract closed $4.725 lower at $146.20. March feeders remain in a secondary (intermediate-term) 3-wave downtrend, with the futures contract posting a bearish outside price range last week. This would suggest last week's high of $151.95 was the peak of Wave B (second wave) of a standard 3-wave downtrend. Wave C (third wave) would now be expected to move below the Wave A (first wave) low of $138.30 (week of December 18). Support below that mark is pegged near $133.40, the 67% retracement level of the previous uptrend from $120.775 through the high of $158.925.

Lean Hogs: The more active April contract closed $4.70 lower at $68.85. April lean hogs remain in a secondary (intermediate-term) downtrend with next support near $66.95. This price marks the 76.4% retracement level of the previous uptrend from $63.75 through the high of $77.25. Weekly stochastics remain bearish above the oversold level of 20%.

Corn (Cash): The DTN National Corn Index (NCI, national average cash price) closed at $3.31 1/2, up 3/4 cent for the week. The NCI looks to be nearing the peak of its secondary (intermediate-term) uptrend as it tests resistance at $3.33 1/2 (last week's high was $3.34 3/4). This price marks the 61.8% retracement level of the previous downtrend from $3.57 1/4 through the low of $2.95 1/4. Weekly stochastics are above 93%, indicating the cash market is sharply overbought. The price gap left between the high of $3.20 (week of January 22) and low of $3.27 1/4 (week of January 29) leaves open the possibility of an island reversal over the coming weeks.

Soybean meal: The March contract closed $12.40 higher at $343.80. The contract posted a bullish outside range last week, indicating an extension of the rally over the coming weeks. The market's weekly close-only chart continues to show a solid secondary (intermediate-term) uptrend supported by uptrends in futures spreads (weakening carry) reflecting continued commercial buying interest.

To track my thoughts on the markets throughout the day, follow me on Twitter: www.twitter.com\DarinNewsom

Comments

To comment, please Log In or Join our Community .