Technically Speaking

Weekly Analysis: Energy Markets

Brent Crude Oil: The spot-month contract closed $2.11 higher at $46.86. While weekly indicators show the secondary (intermediate-term) trend remains down, the spot-month contract posted a bullish outside range last week. This indicates the minor (short-term) uptrend should strengthen over coming weeks. The market has rallied off its test of support at $43.56, a price that marks the 38.2% retracement level of the previous secondary uptrend from $27.10 through the high of $53.73. Look for the minor uptrend to result in a test of resistance between $48.65 and $49.85.

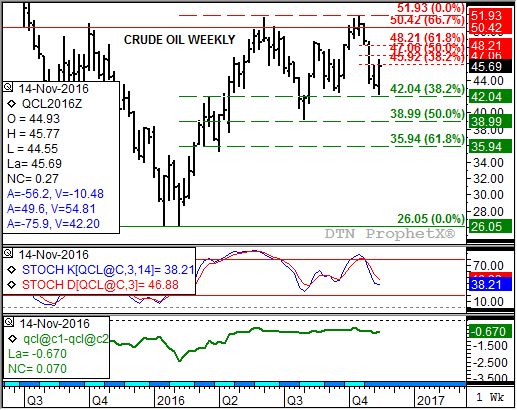

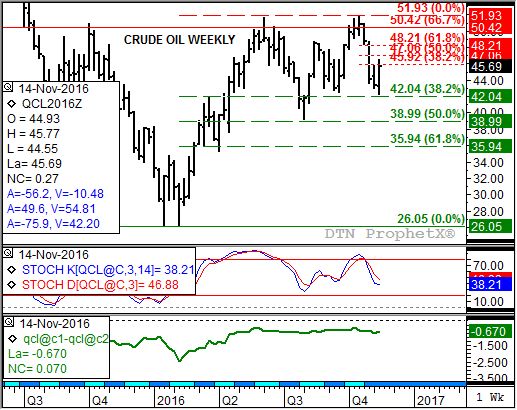

Crude Oil: The spot-month contract closed $2.28 higher at $45.69. While weekly stochastics continue to indicate the secondary (intermediate-term) trend is down, the minor (short-term) trend turned up. The spot-month contract posted a bullish outside range on the weekly chart indicating the market could rally the next few weeks. Minor resistance is pegged at $45.92, $47.06, and $48.21; prices that mark the 38.2%, 50%, and 61.8% retracement levels respectively of the previous minor downtrend from $51.93 through last week's low of $42.20.

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

Distillates: The spot-month contract closed 5.65cts higher at $1.4577. While the secondary (intermediate-term) trend is down, the spot-month contract rallied off a test of support at $1.3674 to post a bullish outside range on its weekly chart. The minor (short-term) trend has turned up with resistance at $1.4578, $1.5000, and $1.5423; prices that mark the 33%, 50%, and 67% retracement levels respectively of the previous minor downtrend from $1.6264 through last week's low of $1.3737.

Gasoline: The spot-month contract closed 3.38cts higher at $1.3391. While the secondary (intermediate-term) trend is down the minor (short-term) trend has turned up. Minor resistance is pegged at $1.3576, $1.4026, and $1.4475; prices that mark the 33%, 50%, and 67% retracement levels respectively of the previous minor downtrend from $1.5370 through last week's low of $1.2681.

Ethanol: The spot-month contract closed 4.6cts higher at $1.566. The minor (short-term) trend has turned up. Next resistance is at $1.581, a price that marks the 50% retracement level of the previous short-term downtrend from $1.671 through last week's low of $1.490. Daily stochastics posted a bullish crossover below the oversold level of 20% last week.

Natural Gas: The spot-month contract closed 22.4cts higher at $2.843. While weekly stochastics indicate the secondary (intermediate-term) trend remains down, the spot-month contract has rallied to test minor (short-term) resistance at $2.858. This price marks the 38.2% retracement level of the sell-off from $3.362 through last week's low of $2.546. However, daily stochastics did not cross below the oversold level of 20% meaning the market could soon resume its downtrends.

Propane (Conway cash price): Conway propane closed 0.25ct higher at $0.4875. Despite the higher weekly close the secondary (intermediate-term) trend remains down. Next support is at $0.4600, a price that marks the 50% retracement level of the previous uptrend from $0.3375 through the high of $0.5825.

To track my thoughts on the markets throughout the day, follow me on Twitter: www.twitter.com\DarinNewsom

Comments

To comment, please Log In or Join our Community .