Technically Speaking

Weekly Analysis: Livestock Markets

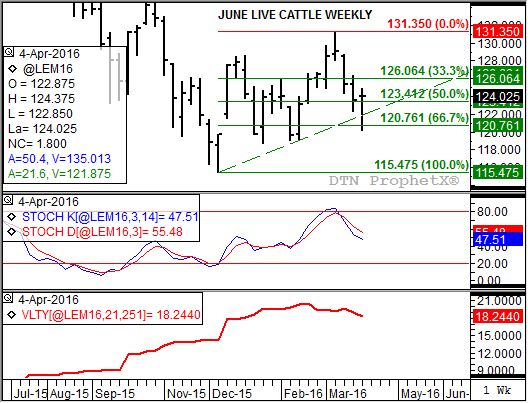

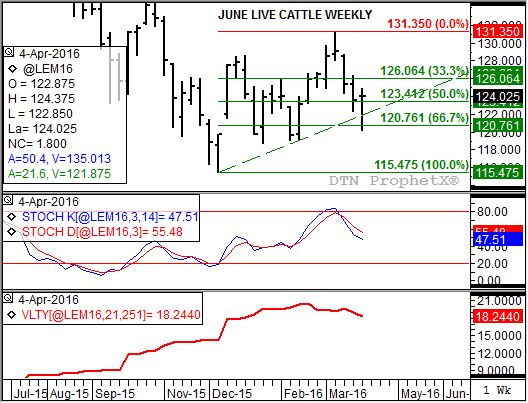

Live Cattle: The June contract closed $0.45 higher at $124.025. The secondary (intermediate-term) trend looks to be sideways with support at last week's low of $120.20. However, the minor (short-term) trend looks to have turned up meaning the contract could make a run at its 4-week high of $131.50 in the coming weeks. Reduced volatility could spark renewed noncommercial buying interest.

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

Feeder Cattle: The May contract closed $1.85 lower at $152.85. The secondary (intermediate-term) trend remains sideways. Resistance remains near $165.90, a price that marks the 33% retracement level of the previous downtrend from $2.1245 through the low of $142.65. Support is at last week's low of $146.975.

Lean hogs: The June contract closed $1.50 higher at $80.875 last week. Despite the higher close the secondary (intermediate-term) trend remains down. Weekly stochastics are bearish after establishing a crossover above the overbought level of 80% the week of March 21. Initial support is at last week's low of $78.525.

Corn (Cash): The DTN National Corn Index (NCI.X, national average cash price) closed at $3.35 1/2, up 7 3/4 cents for the week. The secondary (intermediate-term) trend remains sideways-to-down as the NCI.X continues to post a series of lower highs and lower lows. However, it continues to hold above support near $3.29, a price that marks the 67% retracement level of the rally from $2.81 1/2 (week of September 29, 2014) through the high of $4.05 3/4 (week of July 13, 2015). Resistance remains between $3.49 1/2 and $3.59 1/2.

Soybean meal: The May contract closed $1.40 higher at $273.70. The secondary (intermediate-term) trend remains up with initial resistance at the 4-week high of $276.60. Weekly stochastics continue to grow more bullish below the overbought level of 80%.

To track my thoughts on the markets throughout the day, follow me on Twitter: www.twitter.com\DarinNewsom

Comments

To comment, please Log In or Join our Community .