Technically Speaking

All Quiet on the Southwestern Front

There's an old market saying that goes something like this: Fool me once, shame on me. Fool me twice, you're wheat.

Since the Easter freeze of 1997, traders have not bought into the idea that the HRW wheat crop has been killed. Not until the last emptied truck rolls across the scales at harvest proving production really wasn't there. Even in this age of computerized trade, Watson has learned what human pit traders have always known; wheat can always surprise making it the most difficult grain to trade.

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

If last weekend's freeze across the U.S. Southern Plains had happened to the U.S. Midwest corn crop, the underlying futures market would have gone berserk. Watson (computerized noncommercial traders) would have covered his net-short futures position in the blink of an electronic eye, and commercial traders would likely have been buying into the new-crop December contract. The end result, based on headlines and fear, could easily have been a new-crop forward curve (series of futures spreads) that moved to bullish level of weak carry, if not inverted.

But such is not the case in Kansas City wheat. Yes, this Friday's CFTC Commitments of Traders report is likely to show noncommercial traders have covered some of their net-short futures position, but nobody should be surprised if it is still net-short (as of Tuesday, March 21).

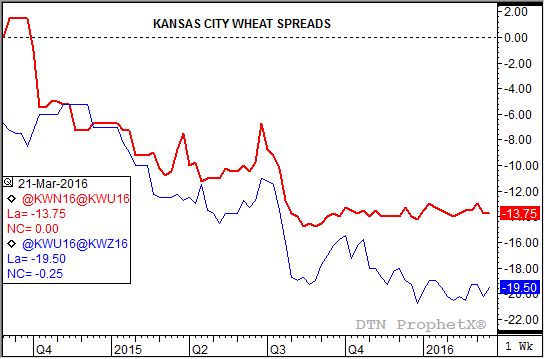

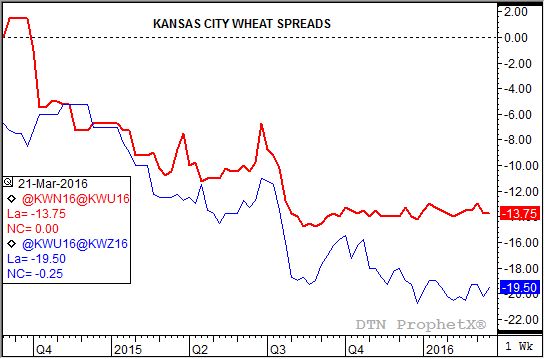

The real interest, though, is in the action of the new-crop Kansas City (HRW) futures spreads. Or should I say the lack of action. If you take a look at the attached chart you'll see that, for now at least, both the July-September and September-to-December spreads remain quiet. Both spreads remain solidly locked in sideways trends at bearish levels of carry despite talk that a majority of the Southern Plains HRW crop may have suffered some degree of freeze damage last weekend.

Another old standard in the wheat market is that one should wait at least a week before getting overly excited about the potential death of the crop due to freeze. Back in 1997 thee knee-jerk reaction was that everything was dead, the crop should be worked up, and the acres planted to milo. However the next 30 days saw the area stay unseasonably cool and damp, allowing the crop to heal to the point that it ultimately produced record bushels.

This time around the damaged crop may not be so lucky, as conditions immediately turned back to much above normal temps and continued dry. Yet commercial traders are patiently waiting for signs of real damage. When, or if, they see these signs the first place it will become obvious to us is in a change in trend of these spreads.

To track my thoughts on the markets throughout the day, follow me on Twitter:www.twitter.com\Darin Newsom

Comments

To comment, please Log In or Join our Community .