Technically Speaking

Weekly Analysis: Grain Markets

Corn (Cash): The DTN National Corn Index (NCI.X, national average cash price) closed at $3.41 3/4, up 6 1/2 cents for the week. The secondary (intermediate-term) trend is sideways with initial resistance at the 4-week high near $3.48 1/2 and support at the 4-week low near $3.35 1/4. Weekly stochastics are neutral above the oversold level of 20%. National average basis weakened a 1/2 cent last week with Friday's NCI.X coming in 23 3/4 below the close of the March futures contract.

Corn (Old-crop futures): The more active May contract closed 5.75cts higher at $3.69 1/4. Weekly stochastics continue to indicate the secondary (intermediate-term) trend is up. However, after holding support near $3.63 1/2 the last couple of weeks the futures contract now needs to move above its previous 4-week high of $3.78 1/4 to confirm the uptrend.

Corn (New-crop futures): The December 2016 contract closed at $3.86 1/2, up 4 3/4 cents for the week. The secondary (intermediate-term) trend looks to be sideways-to-up, with initial resistance at the 4-week high of $3.95 and initial support the 4-week low of $3.81 1/4. Weekly stochastics are bullish as buying interest continues to slowly gain momentum.

Soybeans (Cash): The DTN National Soybean Index (NSI.X, national average cash price) closed at $8.30 1/2, up 6 cents for the week. The secondary (intermediate-term) trend remains sideways between resistance near $8.48 and support at the major (long-term) low of $8.08 1/2. Weekly stochastics are neutral-to-bearish above the oversold level of 20%. National average basis strengthened by a 1/2 cent last week, coming in 47 3/4 cents under the close of the March futures contract.

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

Soybeans (Old-crop futures): The more active May contract closed 4.25cts higher at $8.80 3/4. Weekly stochastics continue to indicate the secondary (intermediate-term) trend is up, though the futures contract needs to move above its 4-week high of $8.88 to confirm.

Soybeans (New-crop futures): The November 2016 contract closed 2.50cts higher at $8.88 1/2. Weekly stochastics continue to indicate the secondary (intermediate-term) trend is up, though the futures contract needs to move above its 4-week high of $8.98 to confirm.

SRW Wheat (Cash): The DTN SRW Wheat National Index (SR.X, national average cash price) closed at $4.20, up 3 cents for the week. The secondary (intermediate-term) trend is sideways-to-down with support at the previous week's low of $4.16. Beyond that is the major (long-term) low near $4.10 3/4. Resistance is at the 4-week high of $4.43.

SRW Wheat (New-crop futures): The July 2016 Chicago contract closed 6 1/4 cents higher at $4.74. The secondary (intermediate-term) trend is sideways as the contract holds above its recent low of $4.64 1/2. Weekly stochastics remain below the 20% level, indicating the market is oversold.

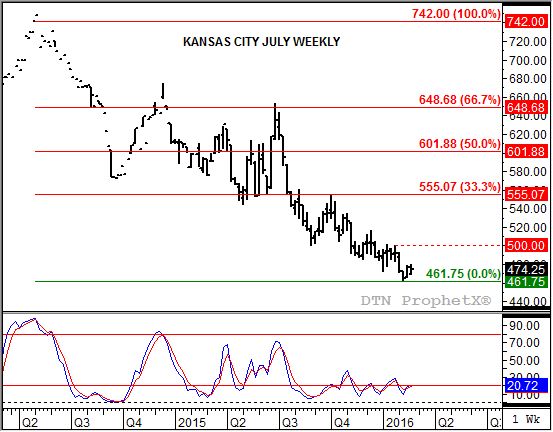

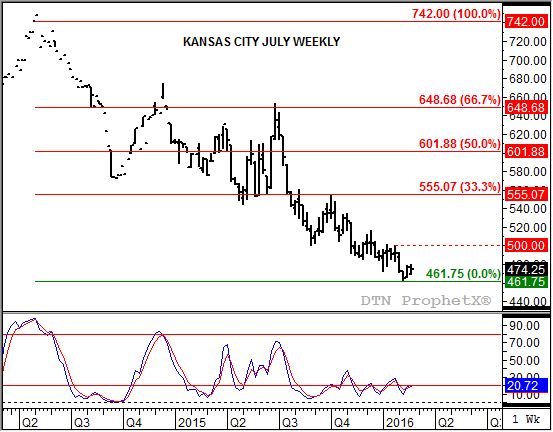

HRW Wheat (Cash): The DTN HRW Wheat National Index (HW.X, national average cash price) closed at $3.94 1/2, up 13 1/4 cents for the week. Last week's rally may have established a turn in the secondary (intermediate-term) trend, particularly with weekly stochastics posting a bullish crossover below the oversold level of 20%. Initial resistance is at the 4-week high of $4.18 1/4.

HRW Wheat (New-crop futures): The July 2016 Kansas City contract closed 12.00cts higher at $4.76 1/2 last week. The secondary (intermediate-term) trend looks to have turned up with weekly stochastics establishing a bullish crossover below the oversold level of 20%. However, the futures contract needs to move above its 4-week high of $5.00 to confirm.

HRS Wheat (Cash): The DTN HRS Wheat National Index (SW.X, national average cash price) closed at $4.65, up 6 cents for the week. The secondary (intermediate-term) trend remains down with initial support is at the previous low of $4.56, then the major (long-term) low of $4.44. Weekly stochastics have not yet established a bullish crossover below the oversold level of 20%.

HRS Wheat (New-crop futures): The September 2016 Minneapolis contract closed 9 3/4cts higher at $5.15 1/2. The secondary (intermediate-term) trend looks to have turned up with weekly stochastics establishing a bullish crossover below the oversold level of 20%. The futures contract needs to move above the 4-week high of $5.26 to confirm.

*The weekly Commitments of Traders report showed positions held as of Tuesday, February 16.

To track my thoughts on the markets throughout the day, follow me on Twitter: www.twitter.com\DarinNewsom

Comments

To comment, please Log In or Join our Community .