Technically Speaking

Weekly Analysis: Livestock Markets

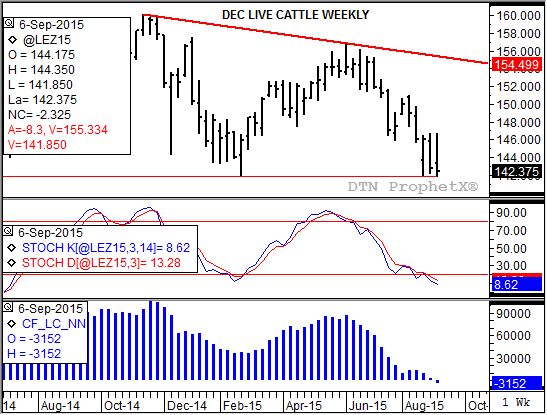

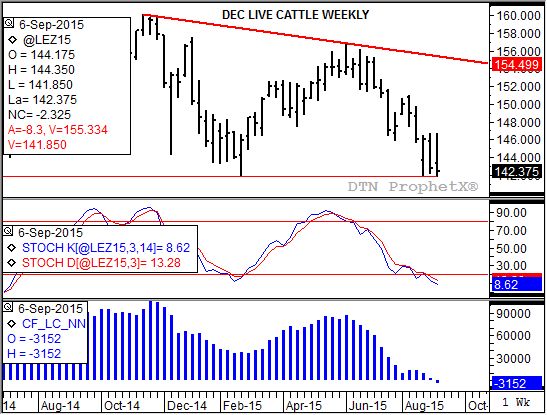

Live Cattle: The December (more active) contract closed $0.40 lower at $142.375. Dec live cattle posted a new contract low of $141.85 last week (thin red line), extending the secondary (intermediate-term) downtrend. Weekly stochastics remain below the oversold level of 20%, while monthly are nearing that level, as Friday's CFTC Commitments of Traders report showed noncommercial traders moving to a small net-short futures position of 3,152 contracts (bottom study, blue histogram). The contract is nearing major (long-term) support between $141.95 and $137.50 on the market's monthly chart.

Feeder Cattle: The October contract closed $0.60 lower at $195.10 last week. The secondary (intermediate-term) trend remains down with major (long-term) support between $192.375 and $184.50. These prices mark the 33% and 38.2% retracement levels of the previous major uptrend from $85.45 through the high of $245.75. However, October feeders continue to consolidate above the contract low of $192.275 while weekly stochastics remain bearish below the oversold level of 20%. Given monthly stochastics have not reached 20% the market could continue move lower, possibly testing the lower end of the above mentioned support area ($184.50).

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

Lean hogs: The December (most active) contract closed $0.70 lower at $62.65 last week. The secondary (intermediate-term) trend remains up, based on the recent bullish reversal (week of August 23) and move to a new 4-week high (week of August 30). Both weekly (secondary) and monthly (major, long-term) stochastics are bullish indicating the market could see continued buying interest. Last Friday's CFTC Commitments of Traders report showed noncommercial interests adding 2,684 contracts to their recently established net-long futures position.

Corn (Cash): The DTN National Corn Index (NCI.X, national average cash price) closed at $3.57, up 27 cents for the week. The NCI.X looks to have reestablished its secondary (intermediate-term) uptrend following last week's solid rally. While weekly stochastics turned bullish, moving back above the oversold level of 20%, a bullish breakout could be confirmed with a move above the 4-week high (last week's) high of $3.57. While daily (minor, short-term) stochastics are bullish, the NCI.X is already testing minor resistance $3.58, a price that marks the 38.2% retracement level of the previous downtrend from $4.06 through $3.28.

Soybean meal: The more active December contract closed $2.50 higher at $309.30. The minor (short-term) downtrend looks to be coming to an end with daily stochastics turning bullish as Dec meal rallied off support at $302.90. This price marks the 76.4% retracement level of the previous minor uptrend from $286.00 through the high of $357.70. The secondary (intermediate-term) trend remains sideways-to-up with the last secondary signal by weekly stochastics a bullish crossover the week of May 31. Initial resistance is at the 4-week high of $320.50.

The weekly Commitments of Traders report showed positions held as of Tuesday, September 8.

To track my thoughts on the markets throughout the day, follow me on Twitter: www.twitter.com\DarinNewsom

Comments

To comment, please Log In or Join our Community .