Technically Speaking

DJIA: Still Headed Down

It is an understatement to say that global equity markets have been volatile of late, with this week alone seeing Japan's Nikkei post a one-day rally of more than 1,000 points, only to follow it up the next day with a 400-plus point sell-off. Though still volatile, the U.S. Dow Jones Industrial Average has actually seen consolidation over the last couple of weeks, a situation that looks to be indicating another sell-off ahead.

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

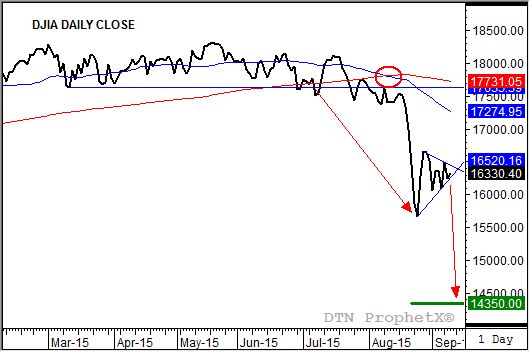

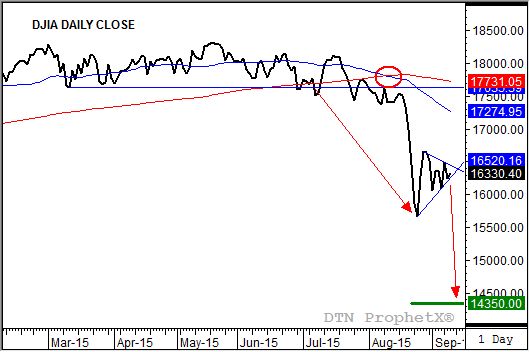

The daily close chart for the DJIA shows a bearish pennant, or in other words a consolidation pattern marked by lower highs and higher lows (blue triangle, right hand side). The standard technical adage is that pennants (and flags) fly at half-mast meaning once the market breaks out of its consolidation phase the second half of the "flagpole" should resemble the first.

Take a look at the DJIA daily chart again. I pegged the initial bearish breakout point at the close below previous support at 17,635 (daily close from March 11, horizontal blue line near the top). This occurred on July 8, with the downtrend confirmed by a death cross (50-day moving average moving below the 200-day moving average) on August 11 (red circle, top right hand side). The initial sell-off, or first half of the flagpole, ran from 17,635 to the low of about 15,666 (August 25), a move of roughly 1,969 points (first red arrow).

If the DJIA sees a bearish breakout Friday, or in other words a move below trendline support of this consolidation phase pegged near 16,320, the second half of the flag-pole (second red arrow) target would be near 14,350. This target is set by subtracting the previous range (1,969 points) from the bearish breakout point (16,320).

It's interesting to note that major (long-term) support on the monthly chart is pegged near 14,395. This marks the 33% (Dow Theory) retracement level of the previous major uptrend from 6,469.96 (March 2009) through the high of 18,351.36 (May 2015). For more information on my view of the major downtrend of the DJIA refer back to the Technically Speaking post on August 31, "China Fed the Dow".

To track my thoughts on the markets throughout the day, follow me on Twitter:www.twitter.com\Darin Newsom

Comments

To comment, please Log In or Join our Community .