Technically Speaking

Chicago Wheat: The Loneliest Kid on the Block

We've all seen the shows and movies, even real life situations, with the one kid on the block who just can't find a friend. The poor soul hangs around the fringes of the other kids, waited to be invited into the game, or party, or what not, only to once again be shunned. Welcome to the world of winter wheat.

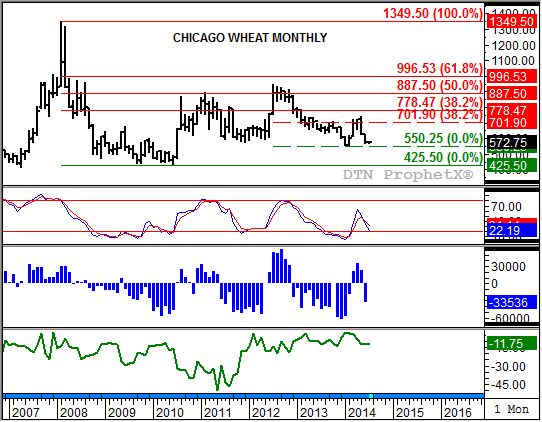

A look at the long-term monthly chart shows the Chicago market to be struggling, as always, to find someone willing to buy. Weekly CFTC Commitments of Traders reports at the months' end (third study, blue histogram) shows Chicago wheat to be one of the few commodity markets noncommercial traders are comfortable holding a net-short futures position. In late June this group reportedly held a net-short futures position of 33,536 contracts, erasing the short-lived three-month foray into net-long territory. In fact, as you look at this study you see that since 2008 noncommercial traders have more often than not been comfortable holding a net-short futures position.

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

The other side of the market, the commercial side, has also shown little love to the lonely boy. The nearby futures spread (third chart, green line) continues to show a solid carry of 12 1/2 cents, just off the June settlement of 12 3/4 cents. Note that the carry in the nearby futures spread hasn't changed much since late 2012, indicating commercial traders are quite comfortable with available supplies in relation to demand.

So with neither noncommercial nor commercial traders willing to befriend the market, what does the future hold for Chicago wheat? At the end of February the nearby contract established a bullish crossover in monthly stochastics (second chart), usually an indication of a move to a major (long-term) uptrend. And in all fairness, the market did see an initial rally off its January 2014 low of $5.50 1/4 to a high of $7.44 in May. But just when it seemed wheat might be able to join the bullish market club, it said and or did something awkward, sparking the aforementioned move away by noncommercial interests.

The most recent cold shoulder has the more active September contract (the nearby July is in delivery) moving toward a test of the previous low. Theoretically, it should approach the $5.50 1/4 in conjunction with a move back below the oversold level of 20% by monthly stochastics. If commercial and noncommercial traders are still unwilling to buy, the next stop could well be the previous low of $4.25 1/2 (June 2010).

To track my thoughts on the markets throughout the day, follow me on Twitter: www.twitter.com\DarinNewsom

Comments

To comment, please Log In or Join our Community .