Technically Speaking

Bearish Follow-Through in Jan Beans

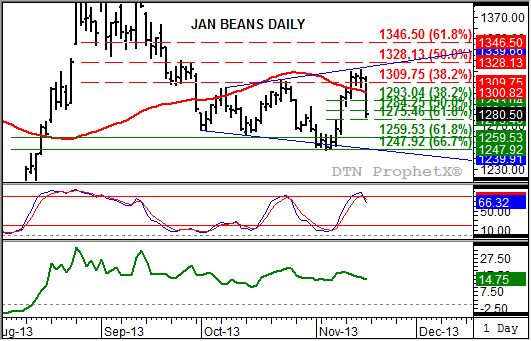

Thursday's blogged post talked about the fine line between bullish and bearish January soybeans were faced with on the close. A settlement below the previous day's price would be bearish, while a close above the previous day would be bullish. As I noted in the comments, the contract closed below Wednesday's price of $13.15, setting the stage for minor (short-term) downtrend.

And as things turned out Friday, the contract wasted little time in following through on Thursday's bearish technical signal. The contract leaked lower throughout the day, gaining momentum late in the session, falling 33 cents and closing near session lows. The daily chart indicates the Jan contract quickly moved below technical price support at $12.84 1/4 to test the next level near $12.75 1/2. These prices mark the 50% and 61.8% retracement levels of the previous uptrend from $12.47 (November 5) through Thursday's high of $13.21 1/2.

Where to from here? Daily stochastics dipped back below the overbought level of 80% Friday, but have a long way to go to reach the oversold level of 20%. If the contract finds technical support at the previously mentioned levels, it could spark a rally back to between $13.21 and $13.28. On the other hand, if the $12.75 1/2 level fails Monday, the contract could slide back to a test of its previous low.

To track my thoughts on the markets throughout the day, follow me on Twitter: www.twitter.com\DarinNewsom

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

Comments

To comment, please Log In or Join our Community .