Technically Speaking

Trying to Get Bullish Chi Wheat

I look back through the archives of my Technically Speaking blog shows it has been a while since I last blogged about wheat. It was back on June 24, 2013 to be exact, when I talked about a bullish reversal in Kansas City wheat. Unfortunately, that particularly signal led nowhere as the wheat market in general stagnated in a sideways trend for much of the summer.

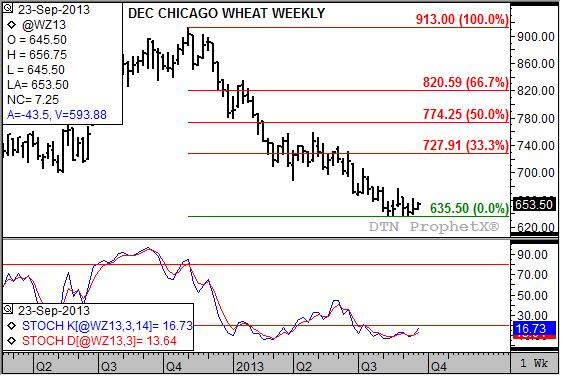

But things could be changing as we move into fall, at least according to technical signals on the more actively traded Chicago December contract. Take a look at its weekly chart. Notice that it too has formed a pocket of trade dating back to early August with a low of $6.35 1/2 (week of August 12, 2013). While it is in the nature of wheat to post a head fake, the December contract never spiked below this low, establishing a possible double-bottom when it touched $6.36 3/4 the week of September 3. From there the contract has slowly, like a sloth on tranquilizers, been building bullish momentum.

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

What technical signal am I looking at? Again it goes back to momentum, meaning weekly stochastics. If you look closely you will notice the faster moving blue line has crossed above the slower moving red line, with both below the oversold level of 20%, thus creating a bullish crossover. If it can hold this pattern through this Friday's close, it will make a much stronger case that the contract has established a secondary (intermediate-term) uptrend coinciding with a similar pattern already established on the contract's daily chart.

Another key will be the December contract moving above its four-week high, this week at the spike high of $6.76 1/2. A rally above this point, assuming it doesn't prove to be a bullish head fake, would confirm the signal in stochastics indicating the market should be ready to rally to its initial target near $7.28. This price marks the 33% (Dow) retracement level of the previous downtrend from $9.13 through the mid-August low. Given that the carry in the December to March futures spread (not shown) reflects a neutral commercial outlook, it is possible the contract could extend its rally to the 50% retracement level of $7.74 1/4.

Take another look at the chart and notice that the stochastics study is littered with failed bullish crossovers since last March. That suggests a certain amount of cautiousness needs to be employed before getting overly bullish the wheat market. Still, if the futures spreads can continue to trend up (weakening carry) and the December Chicago contract climb above its four-week high, it may just be time to finally proclaim the market to be in a real uptrend for the first time in over a year.

To track my thoughts on the markets throughout the day, follow me on Twitter: www.twitter.com\DarinNewsom

Comments

To comment, please Log In or Join our Community .