Fundamentally Speaking

South American Soybean Production

In a recent post I looked at the USDA track record of how well they peg U.S. corn and soybean production from their initial estimates given at their annual Ag Outlook Conference held in February to their final estimate in the following January as part of the annual crop production report.

Their track record is mixed though that is perfectly understandable as production is based on planted acreage, harvested acreage and yields with all three highly influenced by weather conditions.

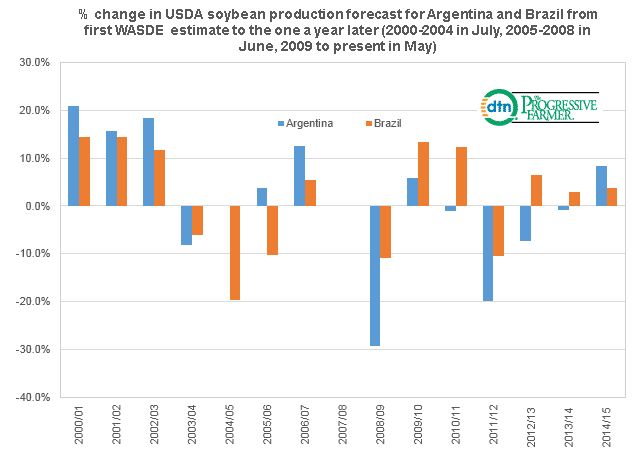

We have done the same thing for the USDA's projection of South American soybean production, specifically output from Argentina and Brazil from the 2000/01 to 2014/15 marketing seasons.

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

We measure production using data from the WASDE report which is the USDA's monthly world agricultural supply-demand estimates from their initial estimate of global oilseed production to their estimate for the same marketing year twelve months later.

Note that up until 2005 the first WASDE South American soybean production estimates were given in July but that year the initial release was moved to June and in 2009 the first estimate was released in May, the same as the wheat and coarse grain projections.

This graphic shows some large deviations that were no doubt associated with particularly good or bad weather conditions in that growing season.

Over the past 15 years the USDA has understated the final Argentine soybean crop by as much as 20.9% back in the 2000/01 season while overstating final output by 29.2% in 2008/09.

The range is smaller for Brazil with an understatement of 14.5% in 2000/02 and the USDA overestimating the crop by 19.7% in 2004/05.

The average over the past 15 years has been for the USDA to understate the Argentine crop by 13.3% and the Brazilian crop by 10.6%.

(KA)

Comments

To comment, please Log In or Join our Community .