Fundamentally Speaking

Soybean Oil's % of Soybean Crush

Soybean oil has been on quite a run lately having appreciated close to 20% in value since the beginning of February.

One reason for the surge has been the ongoing labor strife in Argentina that may interfere with exports from what is the world's largest exporter of soybean oil.

Additional support comes from a strengthening El Nino event that in the past has adversely impacted palm oil production, the largest vegetable oil produced in the world in Southeast Asia, primarily Indonesia and Malaysia.

More recently has been positive sentiment associated with the new renewable fuels directives from the Environmental Protection Agency (EPA) that are deemed more friendly toward future bio-diesel production than ethanol.

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

Accentuating the gains has been unwinding of long soybean meal-short soybean oil spreads that had sent soybean oil's percent of the combined Illinois soybean crush margin down to levels as low as 22% last fall which is the lowest point we have in our database going back to 1992.

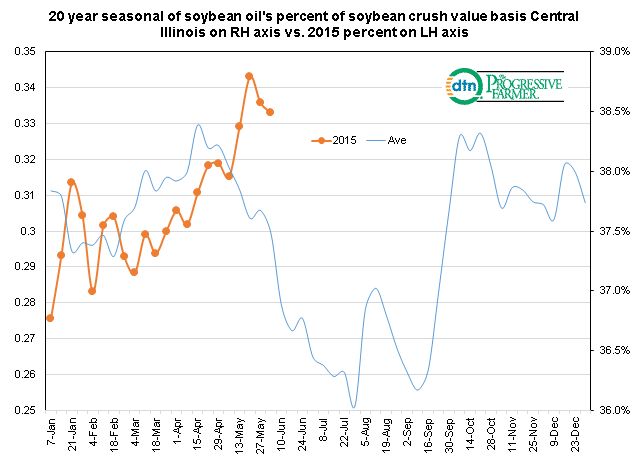

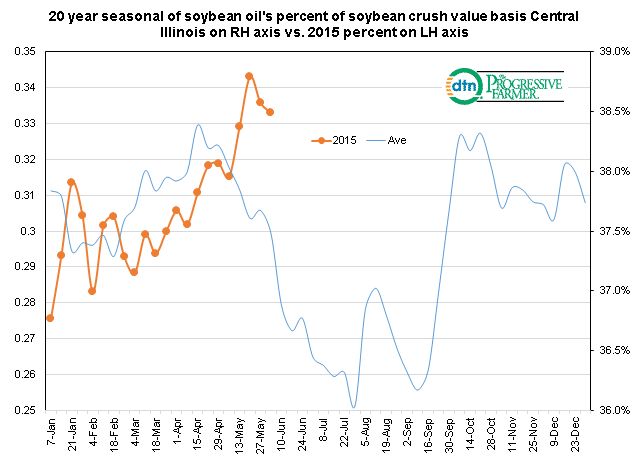

This graphic shows the contribution of soybean oil to the combined soybean crush margin basis Central Illinois in two ways.

First on the right hand axis is the 20 year seasonal that shows on average soyoil's highest percent contribution to the combined crush value occurs in mid-April and then again in mid-October with the low point the end of July.

Note that the normal percent range averaged out over 20 years ranges from 36.0% to 38.5%.

The left hand axis shows price action so far this year and for the most part 2015 price action mirrors the 20 year seasonal with soyoil's percent to the crush value increasing from mid-January into the spring though from much lower than normal levels (29% vs. the average 37%).

Though the increase in soyoil's percent persisted for a month more than normal it appears the seasonal downturn has started and should persist for the next two months before another seasonal upturn starts at the beginning of August that persists through October.

One mitigating factor is that soyoil's present contribution to the crush is abnormally low and bearish fundamentals for the soy complex is usually more negative for soybean meal values than soybean oil.

(KA)

© Copyright 2015 DTN/The Progressive Farmer. All rights reserved.

Comments

To comment, please Log In or Join our Community .