Fundamentally Speaking

Ukrainian Corn & Wheat Exports

Clearly wheat has been the story of the year as new crop July Kansas City futures are up 43% in value since the beginning of February as a devastating drought in the Southwest Plains has and continues to decimate the nation's hard red winter wheat crop.

Adding to the bullish tenor has been the increased tensions in Ukraine as government troops engage in war with Russian separatists and the world wonders how long Putin will refrain from sending Russian troops in.

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

For grain and oilseed markets, concern is that production in Ukraine, which has really expanded in recent years, will fall substantially this year due to lack of credit and perhaps a fall in planted acreage.

The latest USDA attaché report from Kiev notes that the plunging Ukrainian currency, the hryvnia, has collapsed due to the ongoing crisis and this has substantially hiked input costs including seed, pesticides and fertilizers.

Lower projected grain prices have also prompted producers to pare inputs and perhaps some intended ground.

Finally, ongoing dryness this spring is expected to weigh on wheat yields.

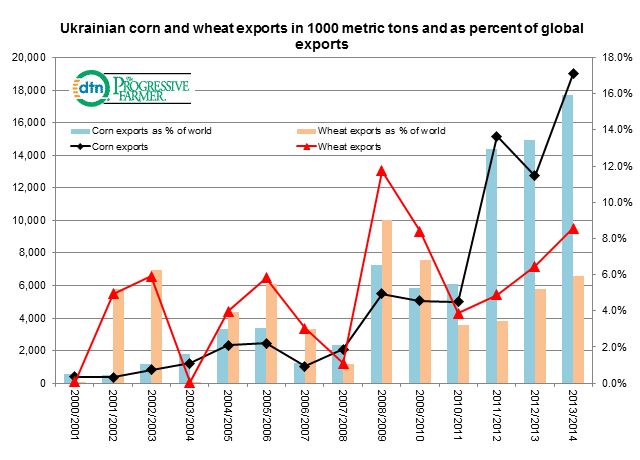

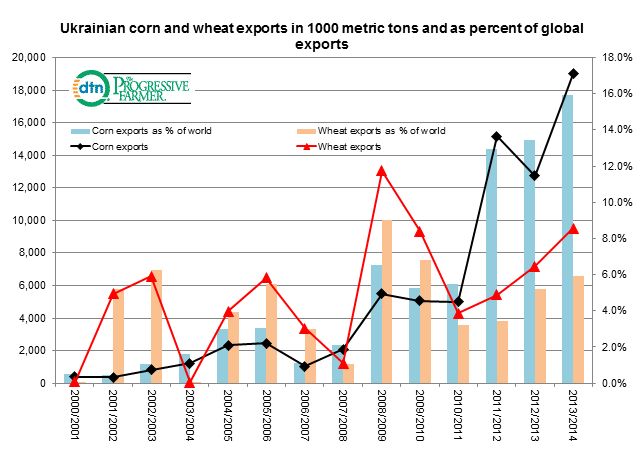

Actually, as reflected in the chart below, it is corn that may be more impacted for Ukrainian production, exports, and share of world trade has ballooned in recent years.

Their corn output that last year was a record 30.9 million metric tons may fall to 25.0 million with some estimates as low as 22.0 million resulting in exports 3.0 million down from 19.0 million that accounted for 15.9% of global corn exports last season.

The USDA is also forecasting Ukrainian wheat exports at 20.0 million tonnes, down 2.8 million from year ago levels with exports off 500,000 tonnes to 9.50 million.

(KA)

Comments

To comment, please Log In or Join our Community .