Fundamentally Speaking

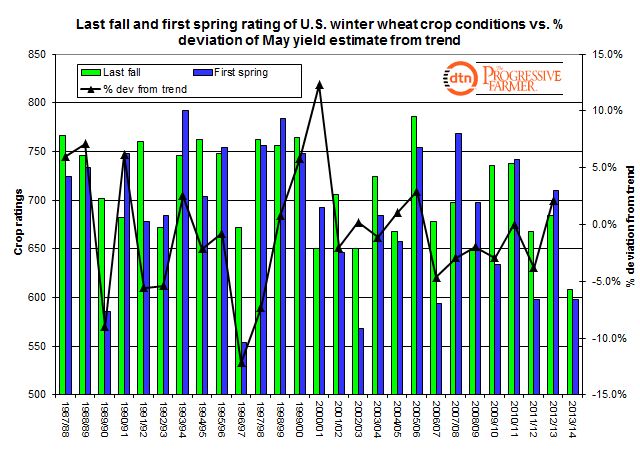

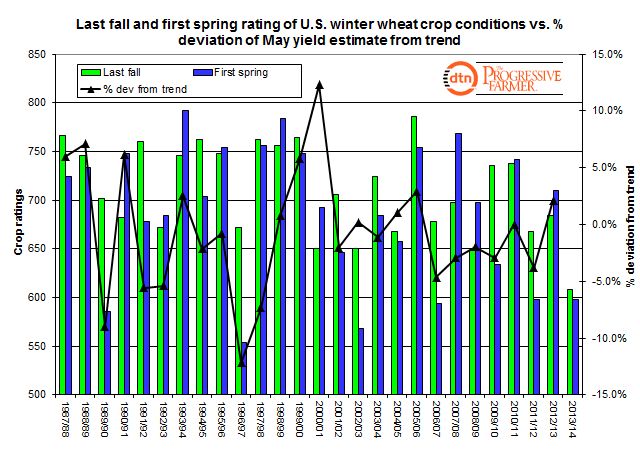

U.S. Winter Wheat Ratings vs. Yields

The USDA released the first spring rating of this year’s 2013 U.S. winter wheat crop and conditions stayed essentially the same over the winter from the historically low level seen last fall.

Adding to the desultory situation is the fact that a review of yield in years when the first spring crop rating was equally as low does not offer much hope for trend or higher yields though obviously much will depend on weather conditions over the next few weeks.

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

Using our usual system where we weight the crop based on the percent in each category and assign that category a factor of 2 for VP, 4 for P, 6 for F, 8 for G, and 10 for EX and then sum the results we calculated the final crop condition of the fall and the first of the spring.

Also plotted was the percent that the first crop estimate in May deviated from the 25-year trend for final yields.

It is said that there is little correlation between fall conditions and yields and the correlation coefficient between the last fall crop rating and the percent that May yields deviated from trend is 10.6%.

The correlation between the first spring rating and the deviation of yields is about five times greater at 50.4% so the relatively low rating does suggest this year’s crop is behind the eight ball.

There have been five other instances since 1987 when the first spring crop rating for U.S. winter wheat had a score of 600 or lower and the average percent that May yields deviated from trend was down 5.8%.

This year we calculate the trend yield at 47.0 bushels per acre (bpa) resulting in a prospective yield of 44.2 bpa vs. 47.6 a year ago.

Two years ago, the first soring rating was also 598 and the May yield was 3.8% below trend.

Back in 2003, the first spring rating was 568 and yields that year did come in near trend so there is some hope especially if the Plains continues to receive increased moisture which appears to be happening.

(KA)

Comments

To comment, please Log In or Join our Community .